Very loan providers also provide an excellent pre-needed you to represent the minimum earnings the fresh new borrower must have in order to be eligible for using the loan.

That it may vary with countries. Certain financial institutions require credit private having an income regarding Dh200,000 per annum to have Middle eastern countries nations, and for United states of america or other countries: $80,000 per annum.

Period could be minimal when comparing to customers within the Asia. Very loan providers also provide a beneficial pre-called for that represent minimal money of one’s borrower.

Mortgage up against property interest rate are typically in the range out of 8.seven percent in order to % yearly.

Therefore very first, find out if the loan interest rates try low in your own country of quarters, incase yes, then you can be thinking about bringing financing indeed there and you can following making use of the fund in India, particularly http://paydayloansconnecticut.com/norwich/ paying off otherwise refinancing your debt.

In the event if that is the scenario, might also need to factor in the expenses inside, like the rate of exchange, handling will set you back and property foreclosure will set you back, and that we will experience in more detail next when looking at threats in order to refinancing.

Threats to help you refinancing

Should it be with respect to borrowing against debt-totally free residential property otherwise refinancing money till the loan’s term period ends, all kinds of refinancing has their chance of extra costs or costs.

Normally, banking institutions charges a total of step 1 per cent of loan matter sanctioned otherwise INR10,000 (Dh485), any type of was highest, just like the control fee.

Particular loan providers can charge dos % since prepayment fees. And if of late commission of one’s equated month-to-month instalment (EMI), you p responsibility is applicable according to condition laws.

One of the main dangers of refinancing your residence comes from you’ll be able to charges you could sustain down to paying off your current home loan together with your distinctive line of domestic security borrowing.

In the most common mortgage arrangements discover a supply which allows the banks to help you charge a fee a fee for doing this, and these fees normally amount enter the plenty.

As the a keen NRI, these will cost you include spending money on a legal professional to ensure you are getting the most effective deal you’ll and you may handle documents your might not feel at ease or otherwise not in a position to filling aside, and lender charge.

Compared to amount of cash you will be bringing from your brand new credit line, but protecting many fundamentally is always worth considering.

The whole process of refinancing can also include extra costs such as for instance home financing operating fee, which one must be considered particularly when researching benefits of your import off mortgage from just one to some other.

In this situation, due to the fact data was authorized by the the facilities, a good cheque of the an excellent matter managed with the this new bank try provided so you can foreclose the loan.

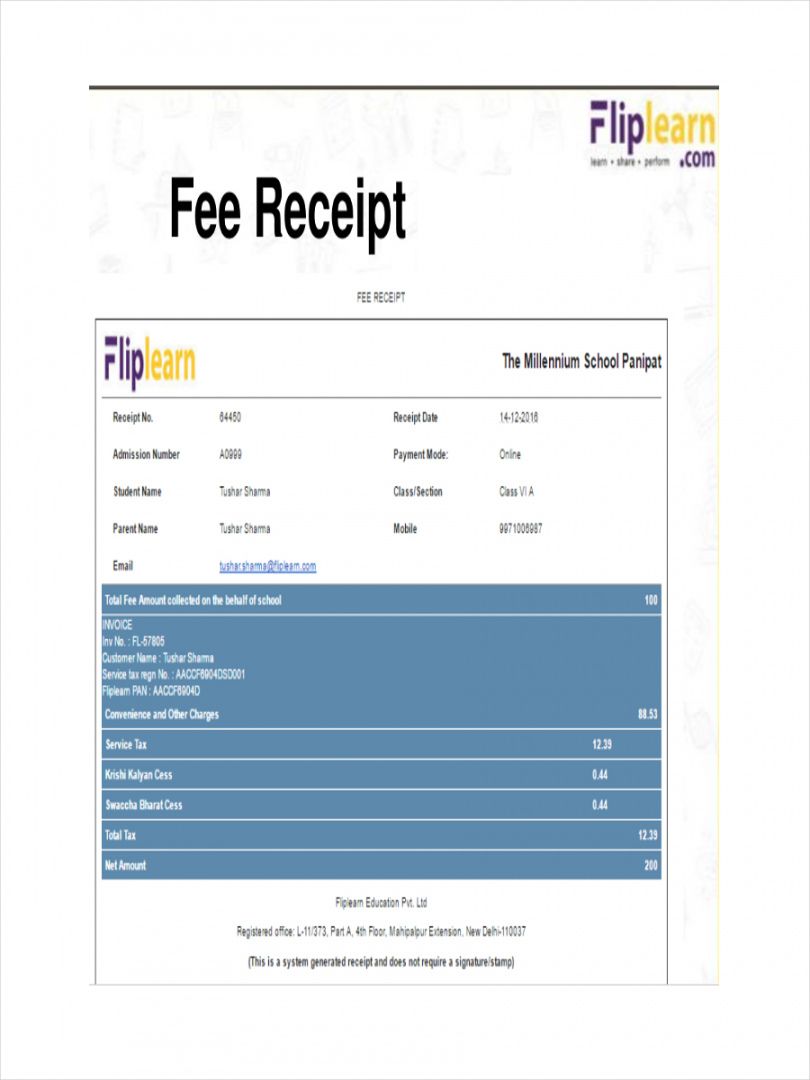

Significantly more banking companies on UAE have to give you deals on their existing mortgage loans, in which they slow down the rate of interest billed to possess a-one-year period, passage to your previous cut-in interest rates toward customers. The picture can be used to have illustrative purposes just. Photo Credit: Given

Since i’ve find out the some other points refinancing is used let us today come across, ways to go about it.

Checking your own qualifications

Now visiting a key standards, that is checking whether you are qualified. Extremely re-finance place is simply be availed if the specific requirements try came across.

First of all, what is expected because of the extremely banking institutions would be the fact minimal quantity of EMIs (otherwise every while you are refinancing against a personal debt-totally free family) currently reduced by the customers. Subsequently, the home is able to undertake otherwise currently filled.