On the wake of your Great Credit crunch out of 2009, area financial efficiency rebounded in conjunction the remainder of the brand new financial industry. By the 2015, community financial institutions had gone back to pre-drama profile with regards to noncurrent funds, internet costs-offs and you may portion of unprofitable establishments. But not, profitability has remained below pre-drama profile in recent times.

Core deposits turned into stagnant over an effective about three-season period getting community banking institutions having lower than $10 billion in property. You to definitely dormancy intended that these financial institutions’ freedom try considerably minimal, in addition to their lending ability is actually rather reduced.

According to a current statement away from , Nearly that-third regarding bankers rated possibly center deposit increases and/or prices off money because their finest complications. Subsequently a good amount of points features resulted in such concerns in the Financial Characteristics industry.

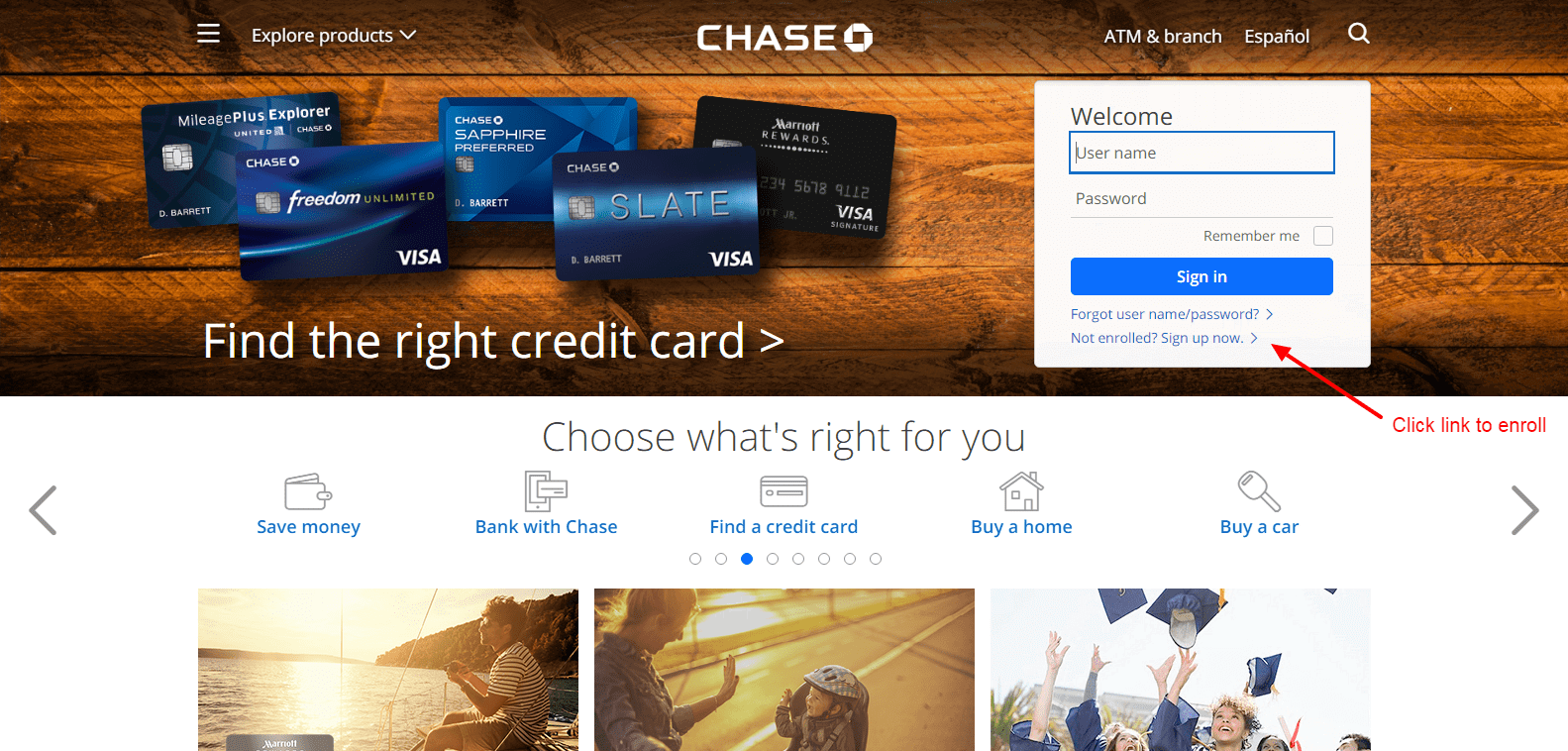

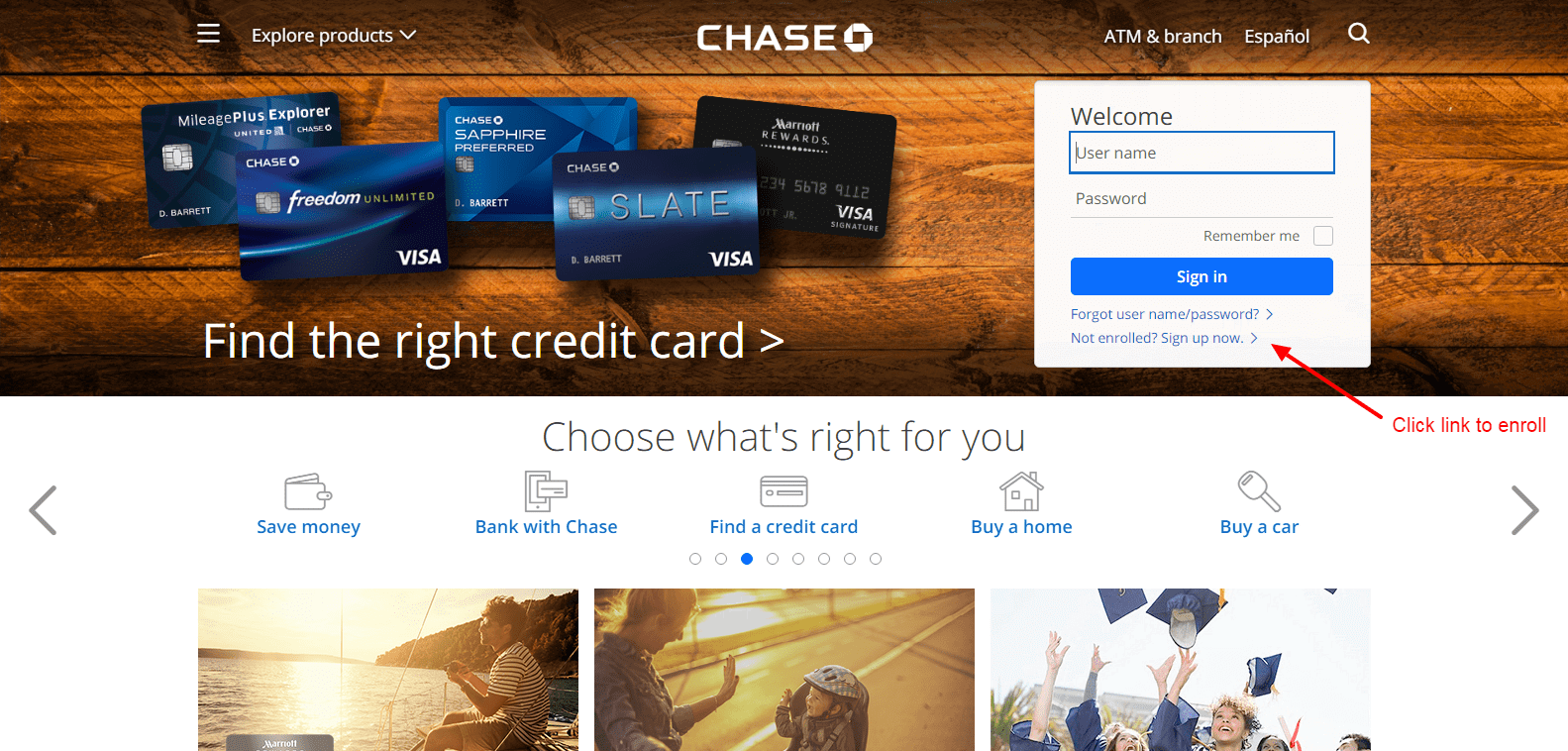

When you find yourself foot people to branch offices ended up being coming down in advance of this new pandemic, COVID-19 expidited the newest development. Branches will unquestionably continue to give really worth with the foreseeable future, however, real financial locations may has a diminishing impact on deposit gains. Revenue experts discover on growing when you look at the-people check outs to your branches here.

9 Financial ]

Additionally, of numerous people are giving an answer to new feeling you to inflation is wearing their monetary arrangements. Having rising will cost you, everyone is spending many depositing shorter. Its critical for financial selling advantages to save users informed on the competitive rates or other financial steps to help counter the latest loss of buying stamina during the inflationary minutes is crucial. 続きを読む →