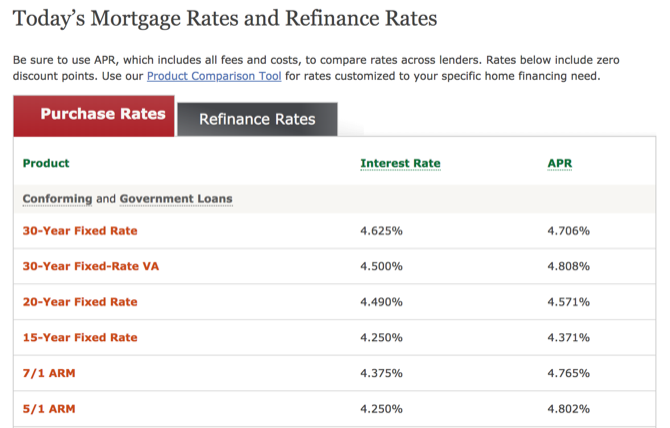

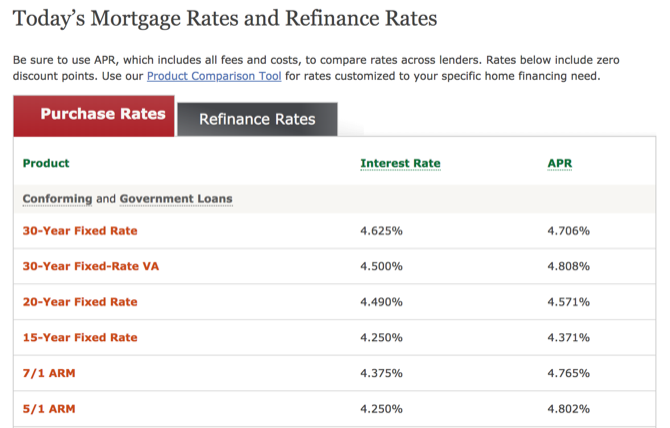

Home loan charges can vary regarding numerous to several thousand dollars and you may defense expenditures that will be important with the homebuying processes. If you don’t discover them ahead of time, they could come since a shock.

In this post:

- Popular Home loan Charge and you can Closing costs

- What exactly are Junk Financial Charges?

- How to Save on Mortgage Charges

If you are like any people who find themselves gonna purchase a house, you will be focusing on protecting to own a downpayment and you may making sure your have the money to help make the monthly homeloan payment. But don’t overlook the home loan costs that can appear inside the techniques and you will increase the total cost of homeownership. 続きを読む →

Particular no-credit-see lenders are more reliable as opposed to others, even when. You are able to Financing, such, enjoys APRs doing two hundred%, nonetheless it offers 31-big date forbearance alternatives if you find payment circumstances.

How to change your credit rating

Renovations aside, taking care of your credit score pays no matter an immediate dependence on borrowing. It will enables you to make the most of most useful prices and you can words, as well as generate financial support requests or ideas a whole lot more in balance and you will affordable.

If you can decelerate your residence advancements for some months, you are capable improve credit history adequate to replace your probability of recognition and you can a lesser interest. 続きを読む →

Just another WordPress site