Navigating domestic settlement costs inside the Texas? So it comprehensive book stops working for each and every component of these can cost you so you’ll know how-to plan the next Tx domestic get otherwise product sales with no shocks.

Quick Bottom line

- Within the Texas, provider closing costs generally are priced between six-10% of property’s developed cost, and you can buyer settlement costs fundamentally range from dos-6%, based on the measurements of the mortgage.

- Settlement costs for the Tx are financing origination fees, assessment costs, label insurance coverage, property fees paid-in arrears, and you may probably even more expenditures instance homeowner’s insurance coverage and yearly resources.

- Texas has the benefit of closing rates recommendations programs particularly SETH and you may Household Star for eligible buyers and you can discussing fees, and using on line hand calculators may help guess and you may potentially cure closure will set you back.

Extracting Tx Settlement costs

Given that title closure costs’ may sound daunting, it’s actually way more simple than you might faith. These are charge getting features must import home ownership out-of owner towards the customer. Very yes, both the consumer and you will supplier have the effect of paying these costs. From inside the Colorado, supplier closing costs basically cover anything from 6-10% of the selling price, if you are visitors settlement costs typically may include dos-6% of one’s house’s developed purchase price.

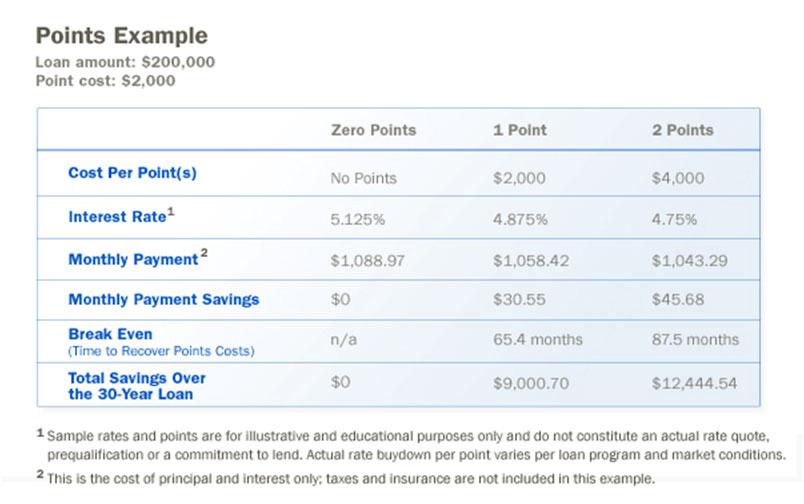

The amount of closing costs should be impacted by new size of the borrowed funds financing; a much bigger loan is likely to produce a smaller sized payment paid. The last closure costs data try announced to help you both customer and seller at the very least three working days before closing.

Customer’s Share from Closing costs

- Mortgage origination charge: shelter the expenses associated with control records and you will installing a loan

- Appraisal fees: costs getting a specialist to assess the new residence’s worth

- Label insurance coverage: safeguards against title problems

- Escrow Costs (Applied because of the Term Company): Charges for handling escrow account, making certain safe transaction and file handling. 続きを読む