To shop for an investment property to rent out is a sure way to help you go after building wealth using home. Certain well-identified You.S. a property moguls come with the exact same small expenditures and you may collected their profiles over time.

There is no make sure your first financial support will end up the foundation through to which you carry out a bona fide home kingdom. However, running a rental property possesses the possibility to produce recurring couch potato money and investment adore. When you’re discover constantly many obstacles dealers need certainly to defeat into road to to get a rental assets, capital is often the most significant barrier to help you entryway.

Most people ponder if they can use an FHA loan as an alternative than conventional capital to acquire a rental assets simply because they won’t have to built a substantial down-payment to locate investment. Throughout the article lower than we’ll handle that matter, and story how to pick a rental property having fun with a keen FHA loan.

What’s a keen FHA Mortgage?

Government Housing Administration finance is geared toward permitting borrowers during the lower so you’re able to moderate earnings mounts. Such fund try granted by FHA-acknowledged lenders, but they are covered by the authorities.

- All the way down credit score standards — only 500

- Lower down payment — only step 3.5 percent of your cost

Consumers having credit scores less than 580 normally are required to build up to 10 % off. However, one to compares definitely that have antique mortgage funding, which often means borrowers to own credit scores away from 620 visit this page otherwise higher and put upwards up to 20 percent off, including see stringent income criteria. Yet not, since FHA individuals expose greater risk through its lower earnings and you may bad credit score, he or she is expected to spend a home loan premium. There was an initial advanced in the event that mortgage are finalized, in addition to a monthly payment that will range from .forty-five to just one.05 percent of the financing according to terms.

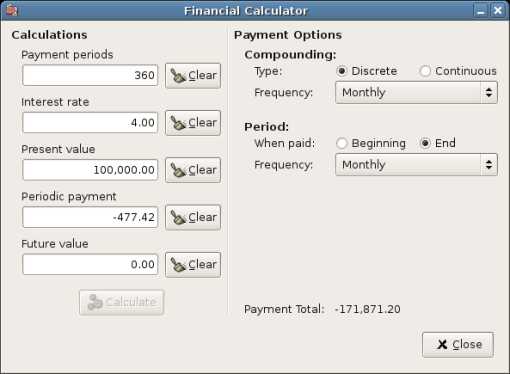

If you intend into having fun with an FHA financing to purchase a keen investment property, definitely sort out every fee and you will money computations so you can let make sure the capital can make an excellent monetary sense.

FHA fund is generally available getting all the way down-earnings borrowers, nonetheless they feature a strict caveat: You must take the household you order. There can be an effective workaround, however: You only need certainly to sit there for starters seasons. After this time, you can move out and book the property for those who purchased an individual-house. Regardless of if you will have to see a unique place to live, you could theoretically play with money from the brand new leasing assets to spend part of your book otherwise home loan towards a different property, considering you may have a great creditworthy renter and they are capable discuss a good market-speed rent.

A different sort of prospective circumstances: You need to use a keen FHA mortgage to order an effective duplex, triplex, or fourplex if you can meet up with the down-payment requirements. You could reside in one of many gadgets and you may rent out others — essentially, you’ll end up an on-web site property owner. You can move out immediately following a year’s some time and book the complete state-of-the-art if you discover with tenants one personal merchandise particular awkwardness otherwise confidentiality complications.

The conclusion

An FHA financing provide a method having novice people so you’re able to dip a toe-in the genuine house pool. Increasing You.S. markets is also expose opportunities to look for leasing services where you could understand resource admiration and also clients spend the money for almost all your home loan. But not, FHA funds try burdened with constant mortgage insurance costs which could dilute any potential continues produced regarding asset — not to mention the fact you will have to shell out far more to the home loan if you have a good vacancy or unoccupied products.

When you find yourself a keen FHA loan will be their entry way to your genuine property paying, definitely cautiously consider all the potential pros and cons before generally making the brand new jump.

Which matter is actually for general advice and you may instructional intentions only. Information is based on research attained to what we think was reliable supply. This is not protected on accuracy, will not purport as over which can be perhaps not meant to be used as the an initial basis for financial support decisions. It should along with not be construed just like the advice appointment this financial support demands of every trader. Speak to your tax mentor concerning your personal items.

Rating Techniques for Controlling A property Riches

Giving your own current email address and you may phone number, youre opting for interaction of Knew. For individuals who receive a text and pick to get rid of searching then messages, answer Avoid in order to quickly unsubscribe. Msg & Study prices can get implement. To cope with researching emails out-of Understood visit the Perform Choice hook up in every email address received.

Realized

- eight hundred W. fifteenth Roadway Suite 700 Austin, Colorado 78701

- (877) 797-1031

Contact us

Realized1031 are an internet site operate because of the Realized Tech, LLC, a wholly had subsidiary regarding Understood Holdings, Inc. (Understood Holdings). Bonds and you may/otherwise Capital Consultative Properties are offered using Joined Agents otherwise Financing Mentor Agencies regarding Understood Financial, Inc. (“Realized”), a brokerage/agent, user FINRA/SIPC, and you will joined financial support agent. Knew try a subsidiary regarding Knew Holdings, Inc. (“Understood Holdings”). See the history in the firm into FINRA’s BrokerCheck.

Hypothetical example(s) was to have illustrative purposes simply and are also perhaps not meant to show the past or coming show of any certain investment.

Investing option possessions relates to higher dangers than just traditional assets and you will is acceptable simply for advanced level people. Choice opportunities are usually ended up selling of the prospectus one reveals every dangers, costs, and you may costs. They are certainly not tax productive and you may a trader would be to talk to his/their particular taxation advisor prior to expenses. Alternative investments possess higher charges than just traditional opportunities and additionally they will get additionally be very leveraged and you may practice speculative capital process, that may magnify the potential for financing losses or get and you can should not be deemed a complete funding system. The worth of the fresh new investment may slide in addition to rise and investors gets right back below they spent.

The website are authored for residents of one’s You whom was qualified buyers only. Inserted Agents and you can Money Coach Representatives might only conduct business which have citizens of claims and you may jurisdictions where he could be securely entered. Ergo, a response to a request suggestions is put off up until appropriate subscription are acquired otherwise exception to this rule of registration is decided. Not all of qualities referenced on this website are available in the condition and you may by way of every member listed. To find out more, please get in touch with this new Know Compliance agency at the 512-472-7171 otherwise