Acquiring home financing instead of ITR and you can income proof is actually difficult not hopeless. ITRs are generally required by loan providers to assess the new borrower’s cost skill and you will monetary stability.

not, specific kinds of borrowers and you can certain points get support house money in place of ITRs. Here are a few tips:

Some body instance short shop customers, traders, and you can agriculturists may well not usually document ITRs. Loan providers you’ll consider most other financial data files such as for example lender statements, conversion process invoices, and you will GST efficiency.

If the a beneficial salaried individual has not registered ITRs but has a constant income and other evidences of work and you can earnings, loan providers can still think about the loan application. NRIs you are going to deal with pressures in the bringing ITRs but can fill in to another country money evidences and you can work deals.

Setting 16: Granted of the companies, Function sixteen certifies one tax has been subtracted in the supply and you may brings information on the cash.

Audited Monetary Comments: To possess thinking-functioning anyone, audited balance sheets, money & loss membership, or any other financial suggestions will be needed.

GST Efficiency: To have entrepreneurs, such production can serve as an alternative choice to ITRs showing organization income and you can costs.

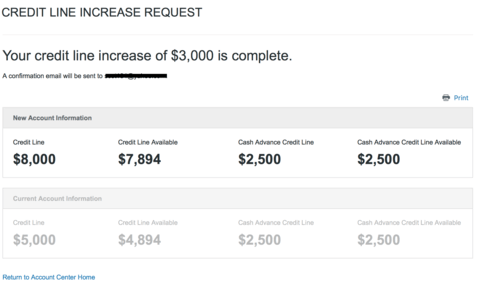

Loan providers might offer high interest levels otherwise sanction lower loan numbers to pay to the perceived risk of lending as opposed to ITR documentation. Borrowers will be expected to make more substantial down payment in order to slow down the mortgage-to-well worth (LTV) proportion, and therefore reducing brand new lender’s chance.

Other lenders has different formula off loans in place of ITRs. It’s important to shop around and you may request multiple banks or financial institutions. This is exactly about mortgage as opposed to ITR and you will money research.

Heat Highlighting Color

The procedure of giving home financing primarily requires checking an applicant’s qualifications, starting with the KYC, ITRs, credit file, and you can assets ideas. Hence, the application form and acceptance approaches for lenders require the entry off data as well as ITRs and you may earnings papers. They can not generally go unaccounted-for. But not, not as much as particular standards, you might sign up for a mortgage in the place of ITR by the appearing what you can do and then make full as well as on-date EMI money.

Score an effective Co applicant:

You can believe a great co-candidate to truly get your financial approved. Although not, brand new co-candidate have to have brand new ITR suggestions and you can proof of income towards hand. Thus, you can just beat the newest obstacle from protecting property loan acceptance in place of an enthusiastic ITR and earnings verification files of the entry an effective combined software.

Favor Low LTV:

You can prefer a low Financing to Really worth (LTV) ratio to increase your chances of receiving a home loan without bringing proof income otherwise ITR. You to entails taking less overall regarding standard bank since a beneficial financial amount, that would lower your entire duty.

Touch base the financial institution representatives:

Contacting their consumer relationship director and/or agencies out of your current financial institution and describing your needs is the 3rd way of get home financing versus ITR.

To ensure the school that you’re in a position to repay the loan and you can, when possible, bring best records in the years ahead. Their savings account will likely be using this type of banking institution.

If you’ve been a frequent customer over the years and you may the KYC is done, the latest officials will assist you in enabling a home loan instead of ITR.

Heat Reflecting Paint

While i was younger, I’d no idea on the ITR. Later, We learned how exactly it affects an excellent borrower’s ability to rating a mortgage. ITR signifies Taxation Get back. It’s a legal document that shows money info earned by you within the an economic 12 months plus the tax and that must be paid down thereon money. Keep reading to learn about home loan versus ITR.

Banks and financial institutions have fun with ITR to measure a borrower’s money and you may capacity to pay back the loan. Banking institutions and financial institutions require ITR given that proof of earnings and you can creditworthiness prior to approving home financing.

The newest Reserve Bank away from India has established you to definitely banks and you will financial institutions can also be approve home loans to consumers in place of ITR when the he has good credit and can bring income-relevant data you to demonstrates thus.

Financial institutions usually you should never render lenders as opposed to ITR. Should you want to get a mortgage in the loans Stepney CT place of ITR, you render almost every other earnings-associated data files such as salary glides, financial comments, otherwise Means sixteen to show your earnings. As opposed to ITR home loan loan providers render finance that have high interest rates and you may more strict fees terms than conventional loan providers.

While notice-employed, which have an ITR is extremely important. Self-functioning somebody may not have money-relevant data files instance paycheck slides otherwise Means 16, making ITR the main file you to