Some financial advisers endorse to possess a twenty five% code, others getting a twenty-eight% signal, but in either case, the concept would be to separate your own capture-house spend otherwise online spend of the .twenty five (otherwise .twenty-eight, if you find yourself passing by twenty eight%), to discover the number you to definitely most closely fits your financial allowance.

Learn The choices

As the a health care provider, you have got more choices for a mortgage than just we. You will probably be able to safe a mortgage loan in the place of an advance payment, and you can without paying PMI.

These are great features! When you influence a payment per month what your location is comfortable, imagine as well as the duration of the loan.

30-Seasons

A thirty-12 months mortgage is called a conventional loan for a description. Even though the loan is spread out over a thirty-12 months several months does not always mean you have to stay in new house for thirty years. That period of your energy is largely the concept and you will desire is determined so that you can provides a reasonable monthly payment on house for which you real time. You could sell our house when, and in performing this, repay the mortgage.

A 30-season home loan typically has a fixed interest rate, so that your payment per month will not changes season more than 12 months. If rates of interest rise nationwide, youre safe as you are closed within the a lowered speed. In the event the rates of interest decline, you would not be able to take advantage of them until you re-finance the borrowed funds. It indicates you take away an alternate mortgage to replace this new old that, and the closing costs that come with control home financing mortgage.

15-Year

You can pull out a fixed-speed financing getting fifteen years instead of 29. That essentially end up in a reduced interest rate but higher monthly premiums. This is essentially maybe not the most suitable choice while an effective resident and you can discover you will simply get into the house to have 5-seven decades.

Changeable Speed Financial (ARM)

A variable-price financial, also known as a supply, would be a beneficial alternative knowing you’ll not getting at home enough time-identity. Much like the identity create mean, from year to year, the speed for the a supply can be to evolve, high or down. Consequently your own payment per month may go upwards otherwise down into the a yearly basis.

For someone into the a property a lot of time-name, the fresh new varying was tiring. But when you will only get in the home for 5-7 decades due to residency, you can gain benefit from the down interest which you wake up top and will online payday loan Idaho trip away one motion throughout the business that already been later as you will features offered the new home.

Make your Party

Once you’ve computed how much cash family you could conveniently manage, be sure to feel the right pros near you.

A client’s representative will help you find the appropriate home from inside the their budget. That person may also help your negotiate for top rate into markets, and not overpay.

Your financial mentor makes it possible to comprehend the huge picture. This person will allow you to devise a plan in order to pay your fund nevertheless benefit from the benefits of homeownership.

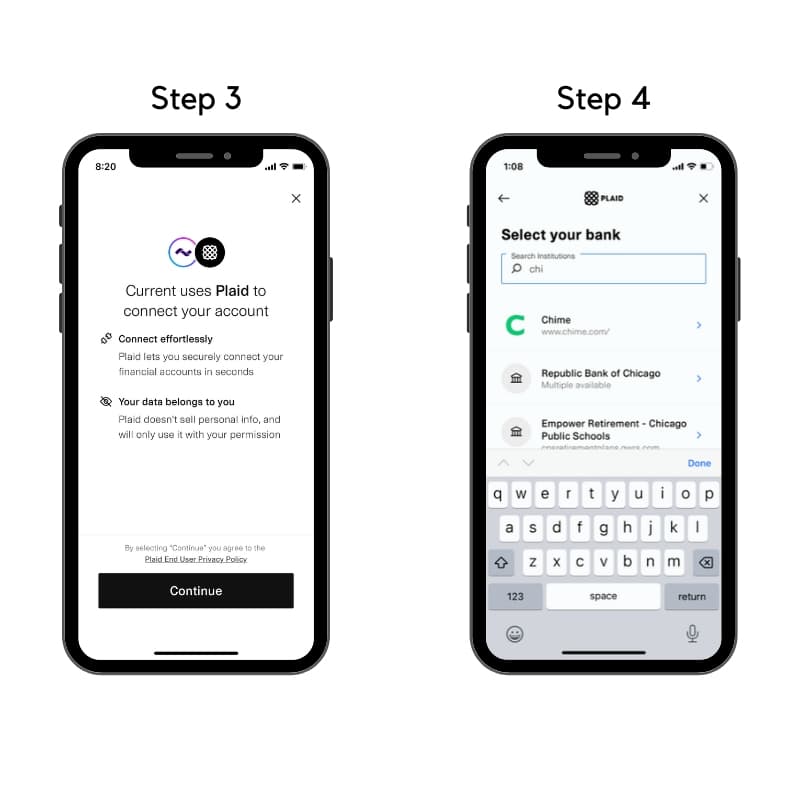

The lender’s efforts are to provide different choices to have financing one to are around for you since a doctor. They may be able give computations as to how more rates and you can types of loan things have a tendency to affect the bottom line: the brand new payment per month.

How D Household!

You may be an early on doctor having limited discounts without work record. You have higher levels of personal debt from the medical college finance, however you want it a house to help you end investing rent and commence strengthening collateral.