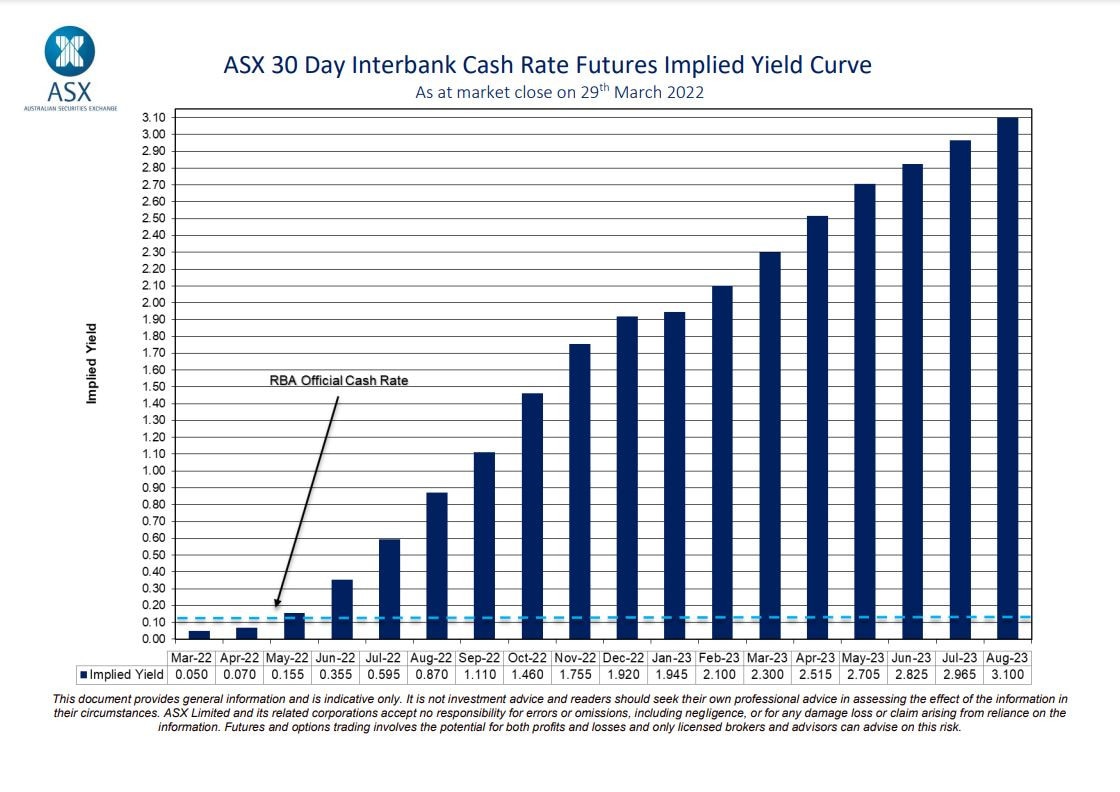

- Borrowed within low interest: Many consumers one grabbed out (otherwise refinanced) fund for the pandemic had the credit potential assessed during the an enthusiastic interest rate less than its most recent rates.

- Current first homebuyers: Earliest homebuyers commonly remove loans with high LVRs because the preserving to own a deposit might be hard. People who ordered recently supply had a shorter time to create guarantee otherwise deals buffers; i focus on basic home buyers who purchased within the past three years.

Previous developments into the arrears

An assessment of recent developments in arrears among consumers with the properties recognized significantly more than means that arrears cost certainly one of extremely leveraged borrowers try higher as well as have enhanced at large rate (Chart dos). It mostly reflects the faster buffers causing https://paydayloanalabama.com/selmont-west-selmont/ them to shorter sturdy so you can changes in its mortgage payments otherwise finances. Arrears costs one of this group together with denied a lot more significantly in the pandemic, specifically for high LVR individuals. In comparison, arrears cost one of current earliest home buyers and people who borrowed at the lower prices is less than the newest aggregate. Each one of these individuals could have been in a position to accumulate deals buffers from inside the pandemic and are usually hence less inclined to getting liquidity restricted compared to already highly leveraged borrowers. But not, the fresh arrears rate those types of who borrowed during the lowest costs enjoys recently increased faster than just arrears prices among previous very first home buyers and aggregate.

Head people out-of housing loan arrears

Expertise out-of financial liaison help our comprehending that the main reason individuals fall into arrears stems from surprise loss of income and you may, in order to a lower life expectancy extent, unforeseen stress on their finances. Such unexpected situations are going to be driven by:

- Idiosyncratic facts not related so you’re able to fiscal conditions, along with death of really works otherwise private bad luck such as for instance ill health or a relationship dysfunction. These types of unexpected situations takes place actually during the episodes regarding strong progress and you may, as such, there’ll always be specific borrowers who feel challenge and then make money.

- Macroeconomic factors and additionally declining genuine wages, large rates of interest and rising unemployment one subscribe a cyclical rise in arrears rates. These situations also known as preferred time situations make it more difficult for all borrowers so you can solution its financial obligation, such those people who are way more very leveraged or with lent closer to their limitation capacity.

Consumers you to feel these unexpected situations dont always enter into arrears quickly. Of a lot consumers features coupons buffers that they may draw to your up to it look for more money or make then improvements on their expenses. As much as half of every variable-rates manager-occupier borrowers have enough buffers in order to solution its bills and extremely important expenditures for at least 6 months, some greater than till the pandemic (RBA 2024). Many individuals also inhabit home with multiple revenue. This makes it unlikely they cure the entire family money. Lenders may also give assistance by providing difficulty agreements under specific factors.

- Cohort-certain matters plus affect arrears pricing, highlighting, such as for instance, credit requirements otherwise credit request of consumers prominent with the season that loan was began. A whole lot more wise financing requirements at origination mode consumers are more unlikely to come across worry firstly, while having is also help individuals to construct resilience across the path of the financing (for example rescuing buffers). This will help to to help you decrease the effects from adverse macroeconomic conditions to the mortgage arrears.

- Brand new seasoning basis, or chronilogical age of that loan, including influences brand new arrears rate. The reason being with increased go out since mortgage origination, even if borrowers have the opportunity to accrue buffers more than a longer several months, the fresh new collective risk of a borrower sense a surprise idiosyncratic otherwise macroeconomic develops. On the other hand, borrowers? situations usually do not change so fast that they get behind on their money after taking right out the borrowed funds. Consequently, arrears are generally large certainly more mature finance and also the mediocre arrears pricing grows on decades (otherwise seasoning grounds) of your own financing pool (Chart 3).