Commonly, homes in the good neighborhoods which need a number of enhancements wouldn’t be flying off the industry in a rush. It offers buyers exactly who may well not or even was indeed able to afford purchasing property inside a much better community, the chance to supply an area which have an inexpensive house and you will up coming renovate they.

six. Preserve control

A separate benefit to purchasing a property that needs developments is the fact you may have full control over the task that’s done. You could make sure that most of the venture is accomplished predicated on the grade of top quality that you want, and you will prefer most of the ability of the project in order to line-up on attention which you have on family.

7. Lower taxes

Property taxes is actually determined depending on the worth of the house or property during the time of research as well as the local possessions taxation speed. And thus households having a lesser value are going to has actually lower taxation. This will just be in place till the upgrades was complete, however it can lead to a large rescuing to possess property owners.

Before you begin searching for an excellent fixer higher family, it is important to look at the fresh new downfalls with the approach just like the better. Although it will be winning, there are drawbacks to be aware of that can impact the success of the strategy.

step 1. Pricey house enhancements

Some house recovery costs can be large, so depending on exactly what should be done, it is possible to become using more you bargained for towards the improvements. The trick is not to find a house that requires solutions which could be more expensive than just your financial allowance. Although not, because we will explanation less than, this is simply not protected given that unexpected can cost you can be crop up, particularly if you’re to get a half-finished family.

2. Unforeseen problems

Fixer higher land commonly incorporate issues that you may not pick 1st. Even although you score property examination, there is certainly almost every other fixes which happen to be needed, and they will be an extra expense. Unforeseen issues can cause most costs that will push your more than funds and you can resulted in opportunity costing many getting reduced profitable. Old house are extremely more likely to issues that may not be found to start with examination.

step three. Unplanned expenditures

A lot more prices are one of the primary disadvantages to purchasing house that need improvements. Due to the nature out of unanticipated dilemmas taking place having fixer higher attributes, this type of programs are susceptible to groing through budget.

Therefore, setting a funds for those household improvements is required, however keep borrow money online with bad credit in mind even though one to finances was reasonable is dependent upon the additional can cost you you to arise with each other the way. Whether it’s a drinking water drip otherwise an electrical blame, even more fixes can cause big unexpected costs.

4. Long term investment

Buying good fixer top home and you may renovating its a job that may simply take several months if not ages, and this refers to not likely as an easy processes. Having investors who are finding a fast funds, this may not be the best solution as fix methods could well be major. For homebuyers, this also could be difficult due to the fact living in a construction region isn’t necessarily possible.

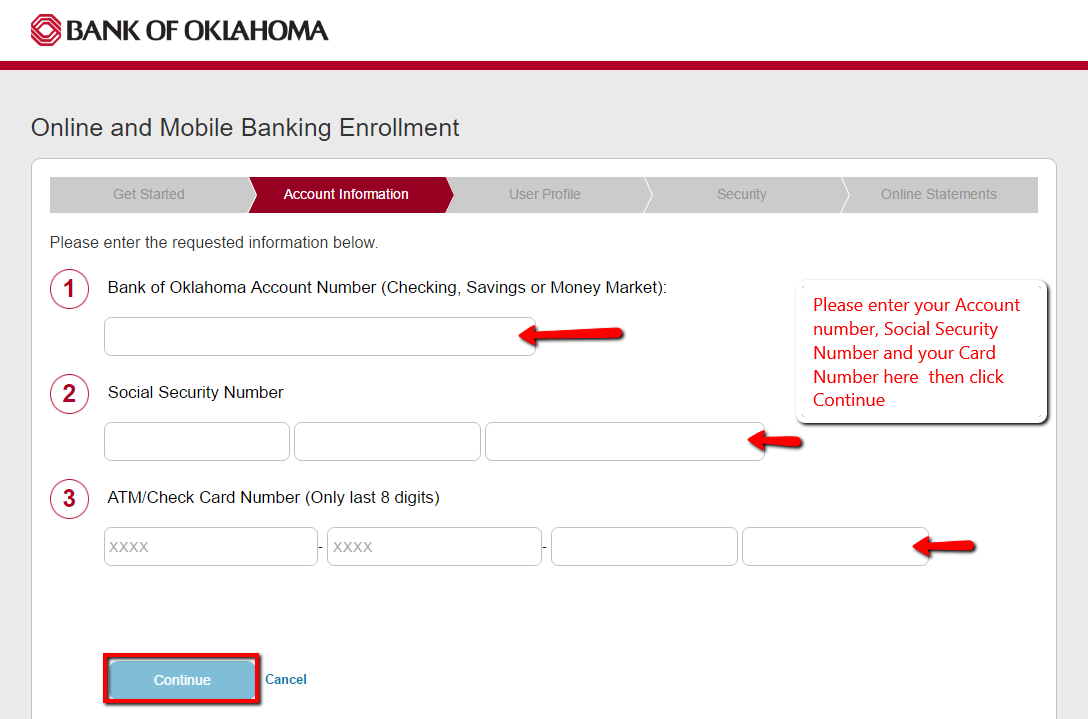

5. Restricted resource selection

Bringing funding to own a great fixer upper domestic buy and recovery is also be challenging since the conventional mortgages wouldn’t cover the home upgrades. Particular loans are often used to safety house home improvements, however you can find will limits to which form of home improvements and you may repairs can help you.

This means, merely exercising a month-to-month mortgage repayment because of it is not usually an alternative. This might be limiting for the opportunity, and then leave your stranded in place of money for the majority vital strategies.