Lea Uradu, J.D. try an excellent Maryland Condition Joined Income tax Preparer, County Official Notary Social, Authoritative VITA Income tax Preparer, Internal revenue service Yearly Filing Season System Participant, and you can Income tax Journalist.

That have a zero-closure costs financial, the fresh new debtor cannot spend settlement costs from the closing. Rather, brand new closing costs is actually rolling towards balance of the mortgage, or even the financial usually charge increased rate of interest on the mortgage.

Closing costs usually are financial charge, tape costs, taxes, domestic assessment will set you back, and more. A debtor can usually anticipate paying several thousand bucks in conclusion costs. Whenever they choose a zero-prices home loan, both referred to as a zero-payment mortgage, they’re going to spend less in the closure but pay a lot more in the loan.

Trick Takeaways

- Settlement costs relate to expenditures off purchasing otherwise refinancing a home.

- A zero-closing-rates mortgage is for a special household or refinancing, where most of the settlement costs is actually folded to your balance or appeal speed of financing.

- You will end up having a high rate of interest and probably a beneficial big financial, and this will not be useful for group.

- Going for how exactly to pay your own closing costs is an essential part regarding choosing whether or not you really need to refinance or not.

Just what are Mortgage Settlement costs?

When you take aside a home loan (possibly for a buy or a great refinance), it is possible to spend individuals expenses, many the next within closure cost publication. Some of the most popular are:

- Lender fees

- Authorities tape charges

- Establishing an escrow account fully for taxes and you will insurance coverage

- Charges for a home assessment

Fundamentally, settlement costs was paid down in the event that mortgage is released to the debtor. Most are paid back by the supplier, with most reduced from the client. A zero-closing-cost financial are a purchase or refinance the place you try not to spend any closing costs during the time of this new loan’s launch.

While having no or lowest costs during the time of closure audio high, remember that when the some thing sounds too-good to be real, it probably are. You may be however probably spend those costs-in the future.

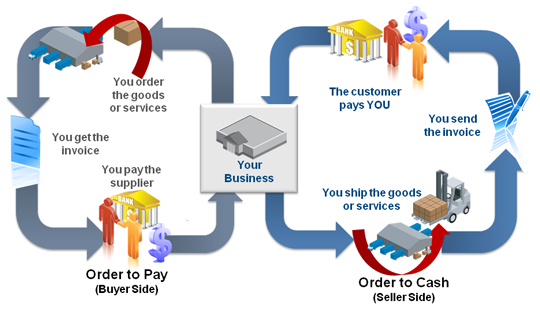

Most terms of your financial is actually flexible, how such prices are paid back is actually up to possess talk ranging from your financial. Loan providers and you can mortgage brokers aren’t effective at no cost, too many of them things still have to become accounted for. Inside a zero-closing-prices mortgage, loan providers generally speaking recover such will set you back in just one of several suggests. One way is always to add them to the main equilibrium off the new loan. Another way is of the charging a top interest so you can perform a no-closing-rates re-finance.

Whether to refinance the home loan is actually an elaborate choice, while the answer may vary based on each situation. How you can determine whether you will want to re-finance would be to run new amounts. Go through the total you to-time closing costs which you can have to pay, do a comparison of one to amount with the count you can save monthly with your homeloan payment. When it will set you back you $2,000 so you can re-finance and you conserve $200 with each fee, then you will pay off the individuals will cost you during the ten weeks.

You could do a comparable types of studies when deciding when the you need to use a zero-closing-prices home loan re-finance. In this situation, be sure to look at how moving this new settlement costs with the your loan affects their payment. You will need to make inquiries like, Is-it beneficial if you ask me to spend $step 1,000 now to store $25 per month for the remainder of the phrase out-of my financial?

Having an idea of just how long you want to remain in your existing house also may help inform your choice-and come up with process. As you never know in case the problem can also be suddenly transform, a beneficial refinance renders quicker experience for many who know already that you are considering transferring a couple of years. Since most refinances have you ever spend some up-front will cost you in return for down monthly obligations, if you intend to remain merely briefly, following and make right back those people very first can cost you might possibly be tough.

No, closing costs try independent regarding deposit. It tend to be bank fees, regulators tape costs, household appraisals, and you will charges having creating an enthusiastic escrow account.

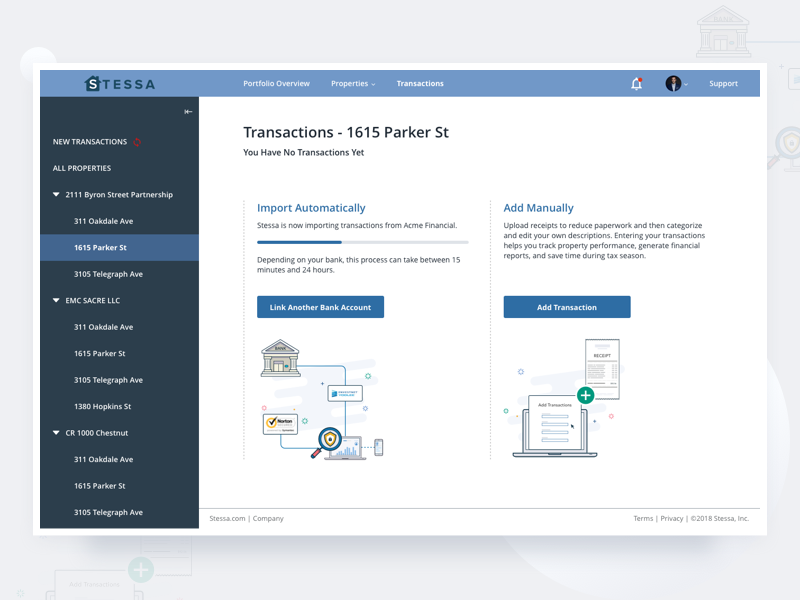

Sure, your bank will discuss settlement costs and will continue reading usually give you the option so you’re able to roll them to your loan’s equilibrium or spend all of them during the closing.

Exactly how much Was Closing costs?

Centered on Federal national mortgage association, closing costs are usually dos%-5% of the value of your financial. Such as for example, when you find yourself purchasing an excellent $three hundred,000 home and placing off 20%, the closing costs tend to range between $7,000 so you can $nine,000.

The conclusion

A no-closing-costs financial azing bargain in the beginning, however, a closer examination shows prospective downsides. For 1, settlement costs cannot go-away-men and women charge are just obtained later on. Work on the brand new wide variety. See what the offer will surely cost and how far you can save monthly. That will help you improve ideal economic decision to suit your state.