With regards to the Virtual assistant Mortgage Warranty Client’s Publication, within prior to purchasing a property, you should know the costs and you may benefits of homeownership. When you find yourself renting property could offer independency and you will restricted responsibility getting maintenance, book changes over the years, the proprietor are available the property, and you can otherwise might not located the safety put when your move.

Across the long haul, owning a home can offer experts for example seemingly stable monthly mortgage repayments and you can an effective way to make wealth for your requirements along with your household members. The fresh new Virtual assistant recommends choosing their goals before you buy a home, eg what you are ready to invest monthly toward a mortgage and you may what other expenditures (taxation, transportation, food, insurance coverage, medical care, child care, cell phone, tools, etcetera.) you must believe. Simply you could potentially determine what meets their houses and you may economic demands.

It webpage provides excellent advice on how to proceed Just before you make a deal on property. This site have a credit file list, a having to pay tracker, how-to talk about mortgage selection, financing estimator, an ending record, a closing disclosure explainer, a guide to closure forms, and more.

step one. Apply for their Certificate of Qualifications (COE): New COE verifies for the bank that you be eligible for the fresh Virtual assistant financial work for. For those who have utilized the loan benefit previously, a recently available COE is generally beneficial to know how much leftover entitlement you really have or even to be sure that entitlement is recovered getting earlier Virtual assistant-backed finance which were paid-in full.

An individual Economic Cover Agency (CFPB) offers products and you can Sheridan same day loan info so you can find the correct family financing at this site alerts facing fraudsters centering on homebuyers weeks just before closing to their new house

dos. Feedback your existing profit: Remark their borrowing reputation, money, expenditures, and you may monthly finances to make sure you are prepared to acquire a beneficial house. Decide how much we want to devote to a mortgage and definitely were closing costs on the rate. Have more suggestions regarding Consumer Monetary Safeguards Agency.

cuatro. Choose a real estate agent: Meet with numerous realtors and select one show your. You could potentially bring your lender’s Pre-Recognition Letter to the real estate professional. Before you sign that have a representative, comprehend most of the arrangements and make certain you know any fees, charge, and you will profits. Real estate professionals be right for you.

Lenders render different interest rates and you will fees, so comparison shop toward loan one best meets your needs

5. Go shopping for property: Consider home on your own price range if you don’t find one that works for you.

- Know your lender’s borrowing criteria: This new Va doesn’t need the absolute minimum credit history, but the majority loan providers use a credit score to assist dictate your interest. Normally, lenders may want consumers to own a minimum credit score away from 620 unless discover a giant down payment.

- Learn your credit history: The consumer Economic Cover Bureau (CFPB) suggests individuals score a totally free copy of the credit report regarding the 3 nationwide credit rating organizations. Credit history may affect the financial pricing, credit card approvals, apartment desires, or employment applications. Which also provides a chance to best mistakes and you may improve your scores. See or use the automated phone system during the step one-877-322-8228 to evaluate your own credit ratings.

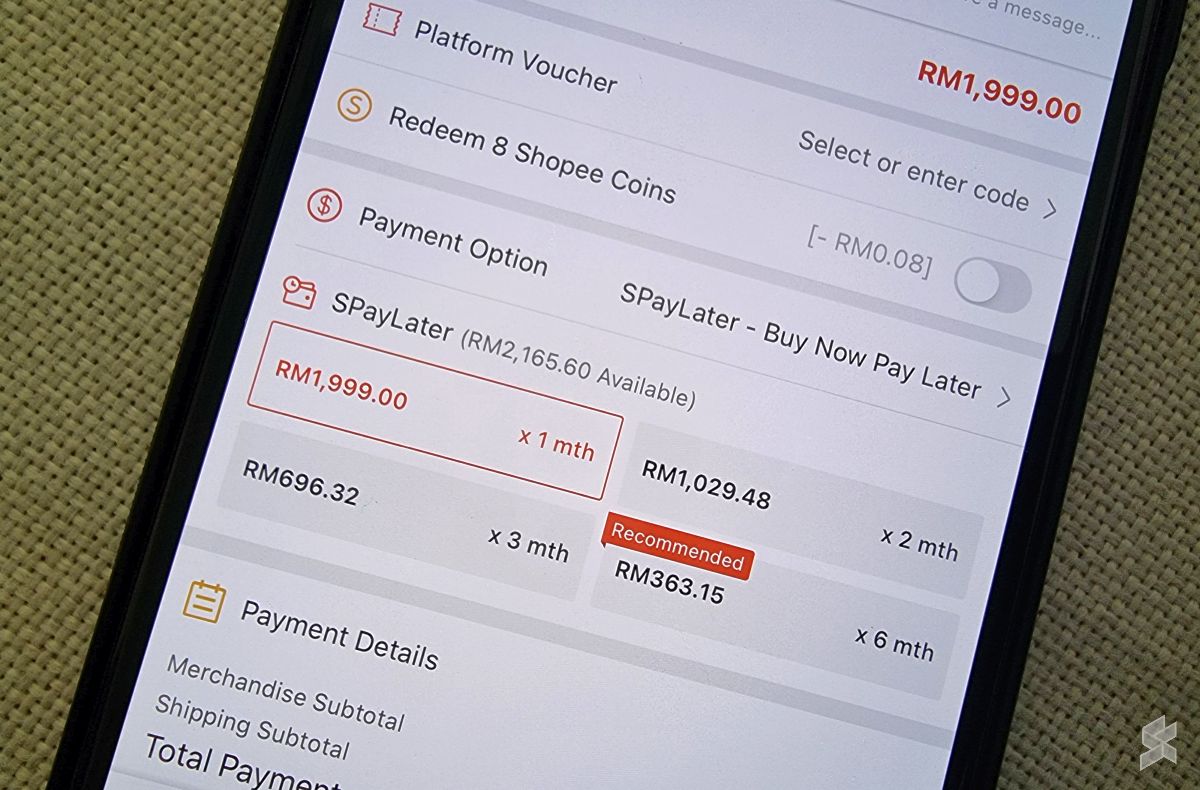

- Research rates for a loan provider: Loan providers bring competitive interest rates, charges, and closing costs with the Va-supported pick money. Start by looking getting a system of people and guidance you trust to. Initiate meeting information about your bank account. You need to inquire multiple loan providers for a loan estimate and review brand new of use book on contrasting mortgage also offers at Mention rates of interest that have CFPB’s Rate of interest Explorer at

- Loan term: Virtual assistant financing shall be provided having thirty years or fifteen years. Shorter-identity funds typically have a diminished interest and lower complete rates but also keeps highest monthly premiums. Come across way more comparisons at the To own Virtual assistant lenders, you could potentially pay-off (amortize) your loan with no punishment or early rewards commission.

- Repaired or Sleeve: Virtual assistant money will likely be fixed-rate or adjustable-rates mortgages (ARM). The most common choice is a fixed-rate financial. This provides a set dominant and you will notice fee about longevity of the mortgage, no matter what cost transform in the united states. Yet not, due to local property taxes and insurance rates changes, your monthly mortgage payment get improve quite each year. Brand new Sleeve loan’s rate of interest is modified periodically based on an enthusiastic index. These types of finance have a low basic rates, but the price can develop throughout the years, thereby will their month-to-month mortgage repayment. Facts can be acquired on

- Opportunity and you can advancements: The brand new Virtual assistant now offers one or two mortgage choices which is often put with an excellent Va get otherwise refinance loan. Such money need to be finalized along with your Virtual assistant financing. Understand the Energy savings Improve and Alteration and you may Resolve financing sections on the Virtual assistant Mortgage Warranty Consumer’s Book.

- To order a condo: Va preserves a summary of acknowledged apartments. In the event your condo isnt to the number, the project must be submitted to Virtual assistant to possess opinion to make certain they complies with Virtual assistant conditions. Discover Section 10 of your Loan providers Manual. For additional issues, you might contact Va on step 1-877-827-3702.

- Attempting to sell your existing home to buy a unique: Fundamentally, you can hold multiple mortgage brokers if you possibly could pay for every the money. When your intend to pick a unique house is contingent to your attempting to sell your existing domestic, their bank is your investment money for the a great mortgage(s) and you will one consumer personal debt you should obvious. Attempt to speak with the bank out-of any required files.

- Unfavorable factors on the borrowing: For the points perhaps not of bankruptcy proceeding, high enough borrowing from the bank could be experienced re-based after you’ve made high enough payments for 1 year once the latest day the last derogatory credit goods try met. Inside the cases of bankruptcies, select Part cuatro of the Loan providers Handbook, Topic 7: Credit score.