This has been said that the attention on the home mortgages was front end-loaded, implying that way lenders charge appeal is actually unfair and you can self-helping maybe even sinister. The next statement is normal.

Did you know that on the typical 31-year mortgage, it requires around 21 years just to lower lower than 50 % of the principal of the loan?

The mortgage industry’s big miracle might have been left from the societal while the Roosevelt government. This hidden miracle has been delivering you (and any other resident) to possess a very costly ride. Your own 6% Low interest rates Home loan Is truly charging you over sixty% or higher!

You are inquiring the manner in which you could be using You to definitely much with no knowledge of they? For the reason that The mortgage loans was front end piled, definition you will be repaying the interest earliest. Very during the all of those very first ages, you aren’t paying the principle. As an alternative, you’re purchasing the banker a different sort of Mercedes.

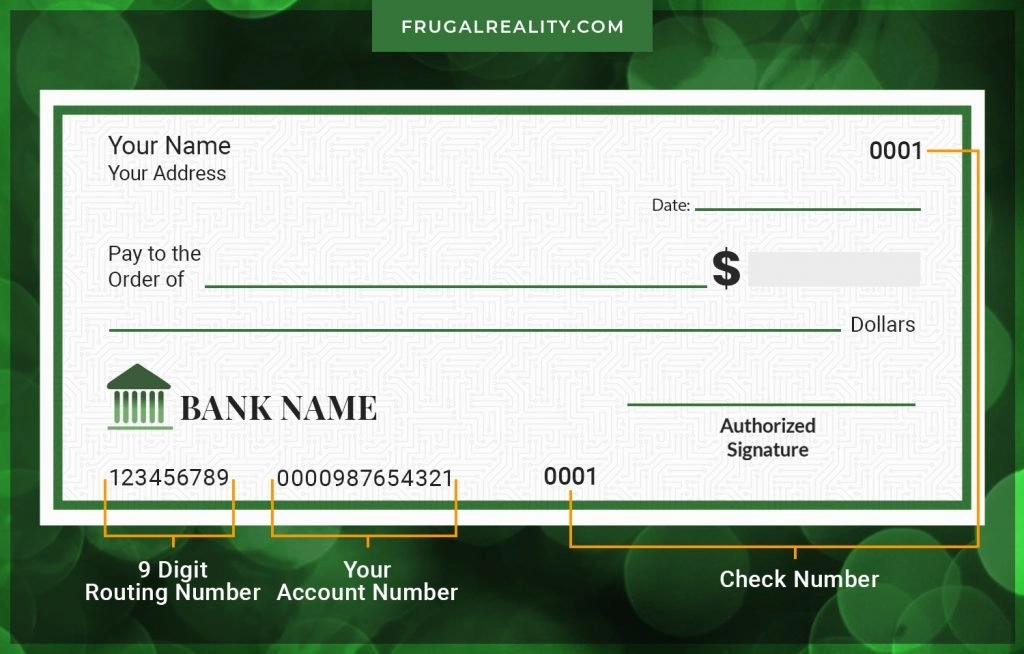

Allows start with this new truthful basis for this standing, that isn’t for the disagreement. The product quality financial price need complete amortization along side term that have equal monthly installments from dominant and you can attention. Instance, good $100,000 mortgage from the 6% getting thirty years enjoys a fees out-of $. That payment, when the produced per month to have 3 decades, usually retire the mortgage. Getting comfort, I will name a totally amortizing financial having equivalent monthly installments a beneficial FAMEMP.

A necessary consequence of complete amortization having equal monthly payments was that the constitution of percentage anywhere between interest and you can principal changes over time. In early ages, brand new commission is generally attract, on the senior years, it’s mainly dominating. This is the informative foundation of the front-end loading argument.

Look at the choice way of paying the new $100,000 mortgage known prior to

The fresh edifice constructed on it base, although not, is totally incorrect. Loan providers gather exactly the attract that they are titled while in the the life span off an enthusiastic FAMEMP. The interest amassed depends strictly with the amount owed them. During the day step 1, the interest payment is actually $500 due to the fact bank owes $100,000, in week 253 the interest percentage try $250 because the at that point the financial institution is actually due simply $50,000.

If a few 6% funds are designed meanwhile, one to to own $100,000 and something for $50,000, its obvious your focus due for the very first often become twice as large since one to toward second. However,, a comparable applies to just one six% financing about what the bill are $100,000 in the one point after a while, and you may $50,000 within an after part.

In the event the high attract payments during the early decades most produced excessive profits to have loan providers, they would favor 29-seasons so you can 15-seasons mortgages, as appeal payments to your fifteen refuse a lot more rapidly. They must for this reason costs large costs to the 15s. In fact, it fees down costs for the 15s.

As they are more lucrative, loan providers is always to charges all the way down rates to your forties. In reality, they charges highest pricing to the 40s.

Put differently, the way in which lenders price fund is only the reverse of what we create expect in the event that attract try front side-stop stacked. Loan providers indeed like shorter identity mortgage loans as their currency converts more smaller, and that decrease the experience of rising rates of interest, and the faster shell out-down of harmony reduces the risk of losses away from default. Mortgage brokers have sufficient to resolve to have rather than saddling all of them with a charge that’s wholly fake.

New FAMEMP, which is the basis of one’s front-end loading dispute, really was designed to meet the requirements regarding borrowers. A proven way, that was quite common inside 1920s, try having borrowers to pay notice merely till the avoid regarding the word, from which section they’d to pay the whole harmony. Once they could not re-finance, which was appear to the fact in 1930s, the contrary are constantly foreclosure.

Another way to repay the balance would be to generate equivalent monthly dominant money, as well as interest. For some time, this was the method found in The fresh new Zealand . In my own example, this would wanted a principal commission off South Carolina installment loans $100,, otherwise $ a month. In the 1st few days, attract would be $five hundred, deciding to make the complete fee $, than the $ to your FAMEMP. Once the commission with this approach perform refuse through the years, the brand new borrower’s ability to pay for certain-listed household would-be less, this is exactly why The new Zealand changed they towards FAMEMP.

Likewise, if the lenders made most earnings regarding the highest attention money inside the the first years of a 30-season loan, they might make large payouts to your a good 40-12 months, hence doesn’t pay down the balance so you can half the initial balance to own thirty years

As far as i normally dictate, brand new FAMEMP was made by all of our early strengthening communities, which have been common institutions and forerunners of modern savings and you can mortgage contacts. From inside the 1934, the brand new newly-composed FHA proclaimed that FHA-insured mortgages needed to be EMPFAMs. The goal would be to permit individuals to help you funds, when you find yourself allowing for systematic (if the sluggish) loss of the balance. In this many years, the brand new FAMEMP has been around since the quality into industry. The fresh planners at the FHA might have been captivated from the believe the FAMEMP was created to generate loan providers steeped.

- Discover Their Help in Picking out the Version of Financial One Best Suits you

- Shop Cost Released Individually by His Specialized Loan providers

- Shop Pricing Fully Modified on Package

- Store Pricing Which can be Always Latest

- Score Him as your Ombudsman And if