This example only deals with one employee, but you can scale it up to accommodate as many employees as you have participating in manufacturing products or providing services. DLYV can be affected by several factors, such as labor rate or wage changes, variations in employee skill levels, differences in the number of hours worked, and changes in working conditions. In this method, employees’ output (worker’s efficiency) will be multiplied by the rate per piece finished rather than the time involved in doing the work. Direct labor examples include a machine operator who works on an assembly line and an accountant who provides services to several clients. These workers’ efforts are directly tied to the creation of the end product or service.

Labor Costing FAQs

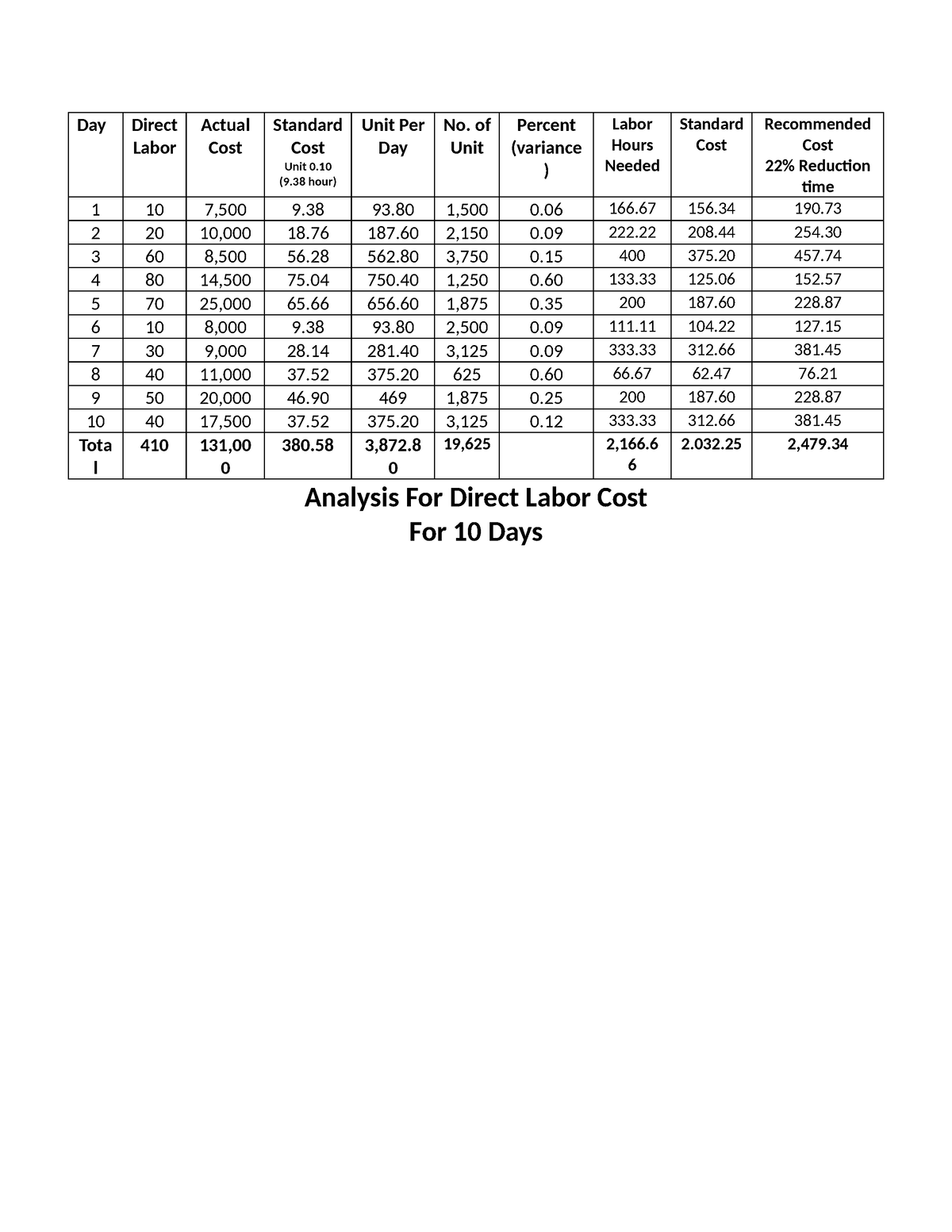

Start by determining the direct labor hourly rate, including base pay, benefits, and payroll taxes. To find the wage rate, add the total value of benefits and payroll taxes and divide by the total number of hours worked in the relevant pay period. Whatever the setting is, tracking and managing direct labor costs and rates can help management optimize the production process, keep costs low, and improve efficiency. Direct labor can be analyzed as a variance over time, across products, and in relation to other process, equipment, or operational changes.

Using Direct Cost to Allocate Overheads

- CFI is on a mission to enable anyone to be a great financial analyst and have a great career path.

- Make sure that your staff are in the right place at the right time, for optimal customer satisfaction.

- When calculating direct labor cost, the company must include every cost item incurred in keeping and hiring employees.

- Although the cost of direct labor is straightforward to calculate, it still requires careful tracking and analysis to account for every dollar.

- All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

An experienced collaborator can help you navigate the complexities of HR and labor management so you can focus on keeping costs down, productivity up, and employees happy. Next, we must determine the total labor costs of the employees working those hours. In the auditing example, one auditor could be a senior team member with a higher salary, payroll taxes, and benefit costs than the two junior members.

Calculating the labor costs directly associated with the production of a product or delivery of a service.

You can find this by averaging together all the absences and illnesses of individuals who work in similar positions to the hypothetical employee in question. Doing so will make it easier to work with, control, and, ultimately, reduce. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

The role of automation in labor cost reduction

Shiftbase will help you plan enough staff to meet the demand and still keep your costs as low as possible. Sling really is the turnkey solution for all your scheduling and direct-labor-cost-management needs. Sling gives you unprecedented control over the scheduling process so you can quickly and easily create staff rotas one month, two months, even six months or more in advance. You can minimize absenteeism — and keep overtime in check — by instituting strategies that promote good attendance.

Add In Other Annual Labor Costs

In this method, the labor cost is calculated by multiplying the time taken to complete a task by the hourly pay rate. Chronic absenteeism impacts an organization’s bottom line with costs that aren’t always easy to track. When employees frequently miss work, management may scramble to find temporary replacements or pay overtime to replacement staff. This extra expense and inefficient resource allocation can quickly strain a business’s finances.

Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Using the information on your paycheck stub, you can estimate your tax refund for the year (or how much you’ll owe). Upgrading to a paid membership gives you access to our extensive collection of plug-and-play direct labor used formula Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs. Take your learning and productivity to the next level with our Premium Templates. Access and download collection of free Templates to help power your productivity and performance.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. It is a crucial part of business operations and can significantly impact profitability. Oyster is a global employment platform designed to enable visionary HR leaders to find, engage, pay, manage, develop, and take care of a thriving distributed workforce. Oyster lets growing companies give valued international team members the experience they deserve, without the usual headaches and expense.

Labor costing is the process of calculating the cost of labor for a product or service. With Oyster’s global employment platform, you can effortlessly calculate global salaries and streamline payroll in over 180 countries worldwide. Discover how Oyster can help you manage and optimize your workforce with ease. Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation. Below is a break down of subject weightings in the FMVA® financial analyst program.