Particular no-credit-see lenders are more reliable as opposed to others, even when. You are able to Financing, such, enjoys APRs doing two hundred%, nonetheless it offers 31-big date forbearance alternatives if you find payment circumstances.

How to change your credit rating

Renovations aside, taking care of your credit score pays no matter an immediate dependence on borrowing. It will enables you to make the most of most useful prices and you can words, as well as generate financial support requests or ideas a whole lot more in balance and you will affordable.

If you can decelerate your residence advancements for some months, you are capable improve credit history adequate to replace your probability of recognition and you can a lesser interest.

- Consult and review a copy of one’s credit report, guaranteeing every information is valid and you may contesting anything that appears wrong otherwise inaccurate.

- Shell out your own bills timely, everytime.

- Decrease your borrowing from the bank utilization if you are paying off personal debt.

- Fool around with playing cards sensibly. Playing cards can also be replace your credit of the enhancing the complete borrowing from the bank availableness, however, on condition that you keep their stability lowest and pay on time.

Generally speaking when people make reference to secured money if you have crappy borrowing, they discuss payday loan otherwise term funds. These different lending is going to be dangerous, so we never highly recommend together with them.

That is because they show up having heavens-higher rates of interest-have a tendency to triple-digit-and need you to definitely explore valuable resources just like your paycheck or automobile because security.

For those who have poor credit, getting wary of the approval odds with a classic lender is actually clear. Although not, it is really not value after that jeopardizing your financial safety. Just before turning to protected-recognition fund, explore the choices with loan providers that provide more sensible terms.

Ought i go back home update finance having bad credit without guarantee?

Do it yourself loans was unsecured signature loans and do not want their domestic security since guarantee. Because the home improvements commonly protected, delivering approved depends on other factors, such as your credit score, obligations, income, and amount borrowed.

What credit score ought i rating a home update financing?

Of a lot lenders don’t identify a minimum credit score however, high light you to financial obligation, income, credit history, and you can amount borrowed are necessary on their lending algorithms.

Upstart, particularly, doesn’t county the absolute minimum get. Revise welcomes results right down to 560, and you will Legitimate also offers fund for consumers with 550 score and you may a lot more than.

Simply how much must i obtain to have a house improve mortgage?

Each bank keeps unique lending conditions to own acceptance. You could potentially fundamentally obtain around your debt-to-money proportion (DTI) tend to pay for you https://paydayloanalabama.com/libertyville/, as much as the new lender’s limitation.

Some lenders limit their loan numbers, irrespective of a great borrower’s borrowing from the bank character and you will DTI. If you like a larger do it yourself mortgage, prioritize loan providers that have huge restrict fund otherwise search Legitimate getting loan providers with large loan limitations.

How much more expensive try a home upgrade mortgage which have crappy borrowing than simply a good credit score?

Property update loan can cost many even more for those who have bad credit. If you have a good credit score, financial support conditions are often so much more favorable and you will save tall currency.

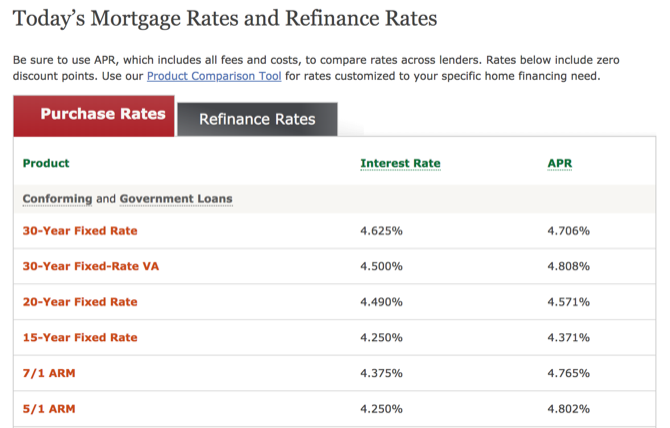

Envision a beneficial $ten,000 home improvement mortgage which have five-12 months conditions. Take a look at the dining table less than observe just how the credit rates change based on your own Apr:

It is obvious how much costly a loan with a high Apr is. Keep in mind that it can save you thousands of dollars in interest versus rescuing doing buy good $ten,000 bucks home improvement.

The way to select a home improvement loan that have bad credit

- Wait to know from the bank. Particular lenders provide instantaneous approvals, while some takes a corporate couple of days supply your a decision.

For starters, no-credit-examine finance usually are full with charges. Interest levels should be astronomical, too. You to integration helps it be almost impossible to settle the loan in the place of delivering trapped for the a financial obligation period.