Borrowing from the bank or Credit ratings range from 3 hundred to help you 850. A high amount indicates all the way down risk. When trying to get home financing, any get more than 740 will be entitled to the lowest you can easily rate for the a particular loan. Another dos problems have fun with 670 towards the lowest FICO rating and you can 740 towards the highest get.

The newest Amounts

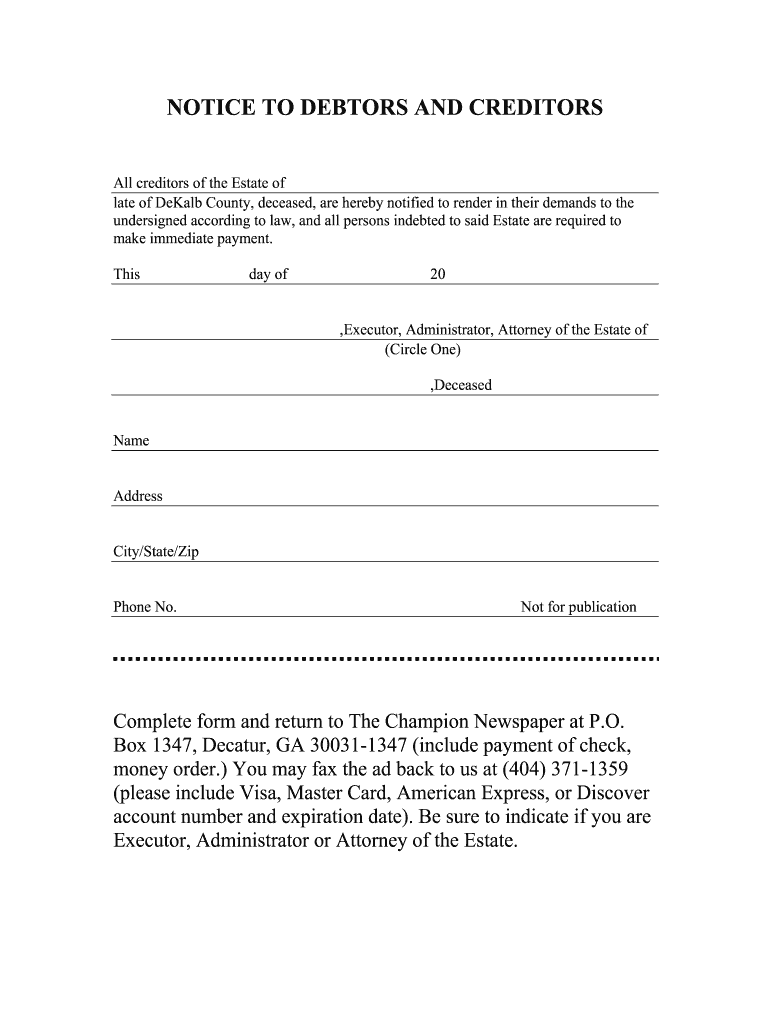

In https://paydayloanalabama.com/satsuma/ this circumstances, the rate towards the a 30-season repaired rates home loan to your sophisticated client (740+ FICO get) is 5.000% (5.173% APR) having a monthly payment regarding $2,494 (excluding taxation & insurance). The buyer that have fair/good credit (670 FICO rating) on a single variety of home loan is eligible to own a speed regarding six.500% (eight.016% APR) that have a payment per month from $3,103. One fee is actually $609 so much more per month, totaling $seven,308 per year the buyer is within that loan. Not only ‘s the lower FICO rating using alot more into the focus (six.5% compared to 5.0%), they are also investing alot more in private Financial Insurance coverage ($259/mo compared to $79/mo). Private Mortgage Insurance rates (PMI) needs by very loan providers whenever placing below 20% down payment. Understand the chart less than to possess a summary of brand new payment variations.

Your skill

It’s easy to find out how far improving your credit can save when buying a house. It will also save with the most other personal lines of credit and playing cards and automobile financing. It can even impression your house and auto insurance pricing. Exactly what can you do in order to alter your credit score for today.

Listed here are 5 ideas to assist enhance your credit score:

- Make your repayments promptly. This is actually the foremost question. They makes up thirty five% of your rating.

- It’s ok to make use of handmade cards however, holding a high equilibrium (balance more 30% of your own limitation, and particularly close to the maximum borrowing limit) can have a negative impact on their rating. The degree of borrowing from the bank you employ was 29% of score. E5 Mortgage brokers enjoys equipment to evaluate your credit lines and you will regulate how much the score is boost if you are paying on the balance to the certain cards versus anybody else.

- Did i mention and then make your repayments timely? Particularly, don’t be late having a lease or homeloan payment. Extremely loan providers render a 15-day elegance period rather than punishment. Just after fifteen-days, you’ll be felt late and might end up being recharged a late percentage. After 29-days, youre experienced late and certainly will increase the bad perception so you can your credit rating.

- If you don’t have one handmade cards, it may be really worth obtaining one. Only make a fee and you can repay it at the end of the few days. It demonstrates what you can do to blow punctually. (get a hold of #step 1 and you will #3)

- Keep an eye on how many profile. If you have plenty of credit cards, you don’t need to personal all of them. Holding a no harmony doesn’t damage, and then have a variety of available borrowing from the bank facilitate. not, inquiring about and beginning a number of brand new lines is hurt credit ratings for the short term.

The past piece of advice is to try to talk to E5 Family Finance just before trying to find an alternate home or refinancing. Not only will one of our knowledgeable mortgage officials advice about a beneficial prequalification and a speeds offer, they could together with let you know certain methods to replace your personal borrowing circumstance.

When you have any queries from the reviewing their credit otherwise was interested to see what you could meet the requirements in order to use, get in touch with E5 Lenders. Even although you curently have a bid or prequalification, reach out to united states to have the next Thoughts. E5 Mortgage brokers sites for the best affairs across the of many lenders and now we do not charge a lot of in love charge.