Dining table from material

To possess experts, Va money provide an often zero-down financial choice that assists manage a route to owning a home. Before you start finding your perfect household, there are certain things to take on to better dictate exactly how much home you can afford with a Va loan.

Exactly how much financial can i manage having good Virtual assistant mortgage? To resolve so it concern, you need to basic have a much better understanding of your very own money and you will debt and what they suggest with respect to qualifying for an effective Va loan, as well as how much you can afford.

- Virtual assistant money are offered of the Va-approved loan providers and supported by the newest Va, which have special terminology for example zero advance payment needs, low-interest rates, with no required private mortgage insurance.

- The main products affecting Va financing affordability were yearly money, monthly expenses, debt-to-earnings ratio, disability, past Virtual assistant mortgage fool around with, and you will credit score.

- Once you regulate how much you can afford getting a good Virtual assistant financial, you should consider additional factors like your capability to rescue and if you should pull out the most mortgage matter that you be eligible for.

Va loan: analysis

Before i consider exactly how much a good Va loan you can afford, let us get a better understanding of exactly what an effective Va mortgage is. Originally written and you can run from the Department away from Experts Issues because an easy way to promote troops coming back regarding WWII a method to buy property, a great Virtual assistant financing has stopped being offered personally from Agencies from Veterans Factors. Rather, these loans are supplied of the Virtual assistant-acknowledged lenders and supported by this new Virtual assistant, meaning that is a borrower standard, the fresh new Virtual assistant reimburses the financial institution. Therefore risk reduction, loan providers provide the latest special terms associated with Virtual assistant finance, particularly no down payment needs, low-rates of interest, and no requisite individual financial insurance.

Circumstances impacting Virtual assistant loan cost

Once you begin our home to get procedure, the initial step should be to determine what your house loan affordability is. You won’t want to buy your dream domestic just to come across that you extremely can’t afford to help make the payments. Evaluating the money you owe, including your earnings and expenditures, and you may how big household your loved ones means, will allow you to most useful understand what Va loan dimensions have a tendency to conveniently match within your budget.

1. Annual money

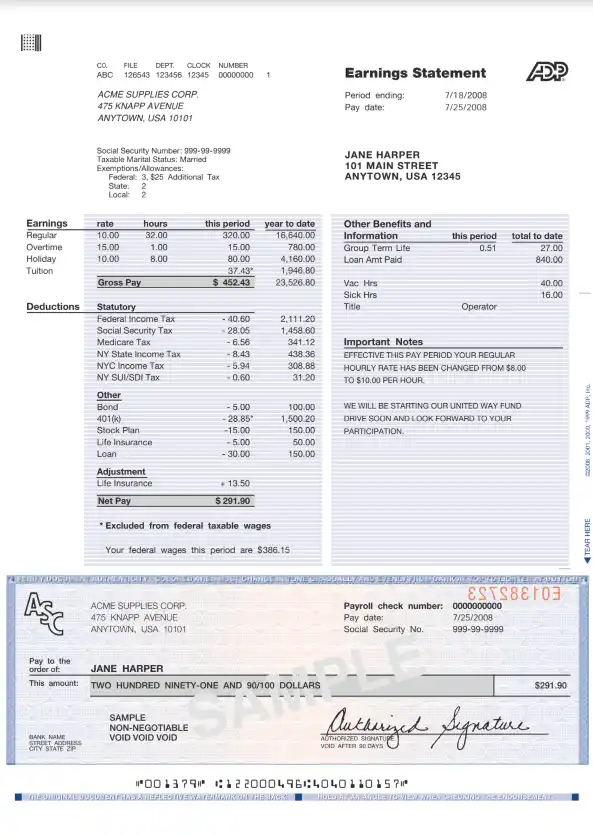

One of the primary choosing things in terms of mortgage value can be your revenues. Lenders may wish to discover proof of all of the proven earnings, like w-2’s, spend stubs, 1099s, proof notice-a position, taxation statements, and you can disability characters. The greater amount of income you have got coming in, the greater amount of family you could constantly afford.

dos. Month-to-month expenditures

Your month-to-month costs are only as essential as your revenue as the it tell you what you will supply and work out their home loan fee. The more expenses you may have, such car and truck loans otherwise credit debt, the fresh new smaller you will have readily available for a monthly homeloan payment, plus the more challenging it would be and also make men and women repayments comfortability.

step 3. Debt-to-money ratio

Your monthly earnings and you can costs are next analyzed throughout your personal debt-to-income proportion. This discusses the connection anywhere between simply how much is available in and what is out each month. Your own important personal debt-to-money proportion is determined by separating the overall monthly financial obligation by the your own total gross income. Like, if your complete monthly money is actually $5,two hundred and your complete monthly obligations is actually $step one,900, your debt-to-earnings proportion could be thirty-six%. With respect to Va loans, extremely loan providers limit the debt-to-income (DTI) proportion on 41%. When your DTI exceeds that number, you might still be considered however, pays increased interest rate or additional charges.

Front-end vs back-stop DTI

Whenever we discuss DTI, most other factors apply at all your DTI formula. Including what exactly is labeled as side-prevent and right back-stop DTI. Front-end DTI refers to your own homes costs, just like your local rental otherwise home loan repayments, assets taxation, and you can insurance. Which number try separated by the earnings and determines the front-avoid DTI loans Jamestown CO. While this count isnt employed for head financing qualification, it does help lenders influence your own Virtual assistant loan value. As a whole, a top-avoid DTI shouldn’t go beyond 31%.

Back-end DTI relates to all non-household monthly costs, including car and truck loans or credit debt. Overall, loan providers want to see a before-avoid DTI off lower than 36%.

cuatro. Handicap and you can early in the day Va financing fool around with

Handicap and you can previous Virtual assistant loan have fun with are something you you want to consider because they can apply at even though might be required to shell out an excellent Virtual assistant financing fee and just how far it would be. While you are an impaired seasoned, features a reddish heart, or was an armed forces spouse, instance, youre excused out of paying the typical financing fee out-of 2.3% of the loan. On the bright side, if you’re not exempt and have had a past Va mortgage, you will has a top Virtual assistant resource percentage, commonly up to step three.6% of your own mortgage. Yet not, such charges can transform for individuals who render a downpayment from 5% or even more.

5. Credit history

Because the Virtual assistant doesn’t mandate the very least credit rating to have good Virtual assistant loan, many loan providers need to select an effective FICO rating off within least 620 to help you be eligible for a mortgage.