As we claimed into the June, tightened federal lending requirements make they much harder and much more expensive to rating mortgage loans getting resource characteristics and second belongings. During the time, Bank of Utah composed a new profile mortgage loan – the fresh Financial support loan – to save users out-of encountering highest cost and you may costs when credit for capital properties (functions that aren’t filled of the proprietor and are generally purchased to make money).

Our company is thrilled to announce you to, into July 6, we and additionally extra a second Mortgage to own people looking to a great mortgage for a moment family (a home, generally a holiday house, it is not stayed in full-time however, isn’t useful for leasing money objectives).

We are going to discuss the the brand new fund in detail, but it might possibly be better to know whenever we first establish the new government alter you to motivated Financial off Utah supply them.

The fresh Government Laws: Informed me

Inside the , this new U.S. Agencies of the Treasury and Government Homes Financing Company (FHFA) launched an amendment towards the Common Stock Get Arrangements between the Treasury and you will one another Fannie mae and Freddie Mac. The brand new amendment implemented a limit into quantity of investment property and you can second mortgage loans Fannie and you will Freddie (one another government-sponsored organizations, otherwise GSEs) can purchase on country’s lenders.

Essentially, this means that mortgage loans safeguarded from the money functions and you can second house dont go beyond 7 % of your full volume which is ended up selling into the GSEs by any one lender. In earlier times, there are zero restriction.

With regards to the FHFA, the latest modification means that Federal national mortgage association and you will Freddie Mac’s company situations is actually consistent with their mission to help with homeownership. Exactly what does this indicate the real deal house people and you can borrowers?

The Government Rule: Exactly what Individuals Wish to know

Towards the business of the seven per cent limit, loan providers can not be particular they shall be in a position to offer every one of its money spent and second lenders to help you Federal national mortgage association otherwise Freddie Mac. Once they aren’t able to sell, many loan providers is obligated to sometimes reduce the quantity of americash loans Midland City finance they originate or shift the purchase price on to individuals regarding variety of additional charge and you can/or more rates.

Among the strongest finance companies on the You.S., with more than $2 mil when you look at the property, Bank of Utah keeps accessibility portfolio fund and financial support, and certainly will continue investment property and you will next lenders in house as opposed to offer all of them to your supplementary market. That is advantageous to consumers for some grounds:

- Their mortgage loans would be owned by the local community financial.

- They usually have the capability to score these funds, despite the newest stringent government signal.

- They’re going to also have access to most readily useful rates of interest, with the help of our the fresh new Money and 2nd Lenders.

The brand new Bank regarding Utah Money Mortgage: How it operates

All of our fund was balloon fund, definition month-to-month mortgage repayments derive from regular 31-seasons financing conditions, but the finance are due immediately after 15 years.

- Purchase, re-finance and money aside re-finance welcome

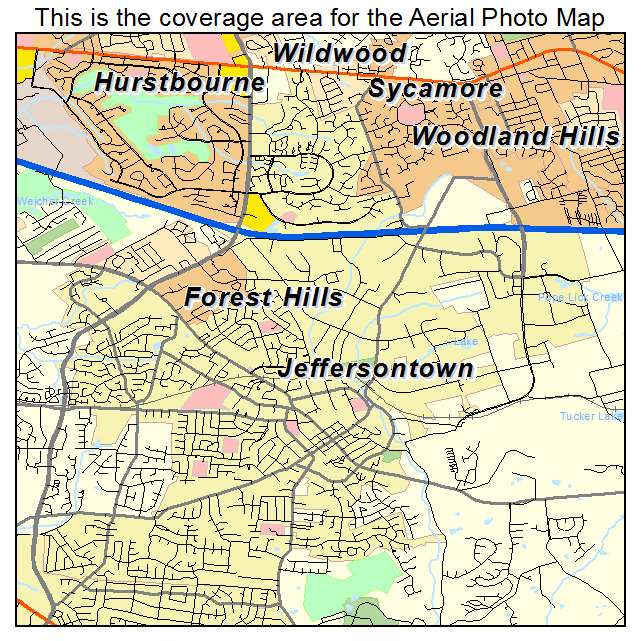

- Designed for money functions located in Utah, Arizona, Tx, Idaho and Vegas

- Loan amounts out-of $75,000 so you’re able to $600,000

- Specific fico scores, loan-to-value percentages and you may obligations-to-income percentages plus expected

While looking for an investment property or 2nd household, reach out to a lender away from Utah mortgage administrator now to talk about the loan requirements and operations in detail. The conditions is similar to Fannie mae and you will Freddie Mac’s, as well as in some instances, Lender away from Utah could even bring better interest rates by continuing to keep the mortgage internal in place of attempting to sell they.