That have price of characteristics to be expensive within the wanted urban centers, moms and dads is actually going into assist their children log in to this new assets ladder. One of the most prominent means these are generally helping is by as good guarantor utilizing the security in their own property and on uncommon era, by being combined individuals.

If you’re guarantors are generally always assist borrowers prevent loan providers mortgage insurance policies (LMI) advanced, joint consumers assist with the latest upkeep of one’s mortgage in the place of the guarantors. A borrower and their spouse/ companion typically play the role of joint borrowers and banking companies generally only ensure it is a good borrower’s instant household members are an excellent guarantor.

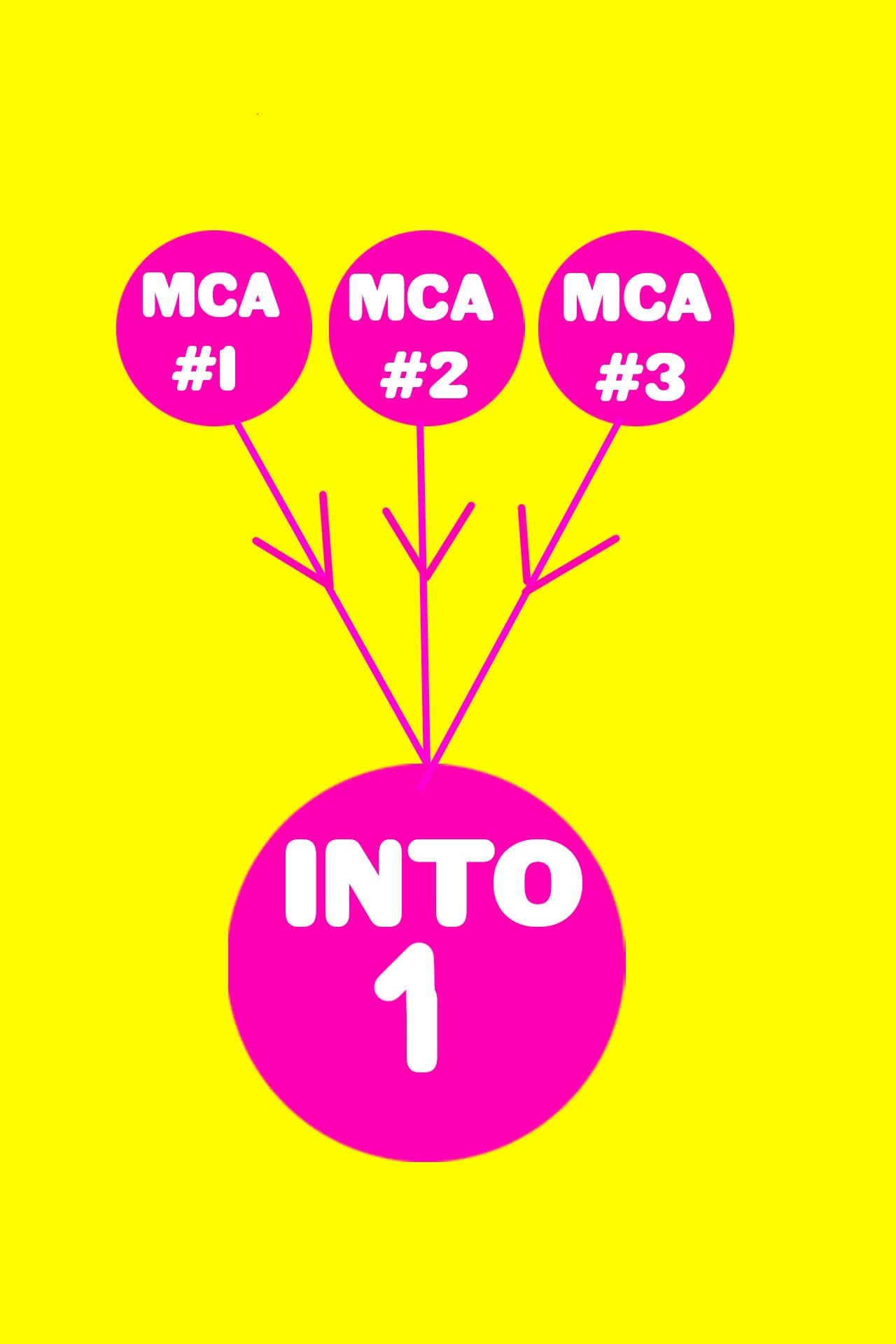

Mutual Debtor

How to remember a joint borrower is actually people who can co-own the house with any other person toward loan application. Shared consumers assume an equal portion of the mortgage accountability just like the brand new prie seems towards all the financial documents and additionally they was registered to the label.

Its fundamentally understood that the joint borrower would be contributing with the the borrowed funds payments in addition to their income and you can/or property will help to the financing serviceability.

Joint consumers will often have equivalent liberties (combined renters) to your possessions, although capable https://paydayloanalabama.com/lillian/ also individual a percentage regarding property (clients in accordance in just dos customers). Where there’s two or even more citizens (clients in common), a borrower normally own only step 1% regarding a house, according to equity sum of any stockholder.

A combined debtor could probably allege people income tax positives of a good investment home loan, particularly desire deduction, except if he is renters in accordance, after that only commission equalling its express of one’s attention costs often become claimable. Consult a licensed taxation coach to ensure just what applies on your personal circumstances.

If the a joint-tenant manager becomes deceased, the house or property ownership are relocated to the remaining group where as in the a great renter in the common’ ownership, just the display owned by passage party transmits so you’re able to his or their particular home.

The fresh new Guarantor

An effective guarantor can be used usually to simply help no. 1 debtor(s) prevent purchasing LMI, in this situation the primary borrower typically has the funds to help you hold the mortgage but could not have sufficient deposit so you can contribute with the purchase.

A great guarantor does not have any the same property rights since a combined debtor as his or her name is just toward financial and never for the identity of the house. Its role is strictly to include ensure therefore the financial number are below 80% of one’s overall property value the bonds.

As opposed to a mutual borrower, the new guarantor generally gets accountable for default only adopting the bank features worn out any technique of range contrary to the first borrower(s). It is vital that the latest guarantor look for legal advice to their duty off one a fantastic responsibility should your borrower non-payments.

Guarantors will be in most readily useful monetary position than the number one debtor and you will, because they don’t individual one risk about assets getting ordered, sometimes they help regarding mercy (i.elizabeth. a pops permitting out a grownup child).

Really loan providers don’t let guarantor service unless new individuals try to get an initial house we.elizabeth. maybe not getting money spent pick or in which individuals just want to refinance or take cash-out of their property

Loan providers will allow restricted be sure getting place contrary to the guarantor security, typically the be certain that amount do not meet or exceed a specific portion of new guarantor’s value of.

Family unit members hope, Members of the family ensure and you will guarantor are some of the popular terminology put by various other loan providers for similar unit.

Points to consider

Promising a mortgage should never be drawn gently, it is not a life sentence however the guarantors need to envision all of the ramifications ahead of agreeing to incorporate protection be certain that. Preferably, once the number 1 debtor (s) has already established a chance to become more economically stable and you may depending equity within property, most of the activities can also be envision refinancing brand new the mortgage to remove the new guarantor(s).

Bear in mind there is certainly charge associated with which. Your lender might think about it damaging the financial if it’s repaired and you will over in advance of maturity, whereby a punishment may pertain. Very ensure that the conditions are unmistakeable whether your guarantor desires away early.