Once again, the new FHA makes sure HECMs. Loan providers and you can agents exactly who sell reverse mortgage loans either emphasize that the mortgage is federally covered, as though this insurance is mostly towards the borrower’s security. However, it insurance rates system mostly gurus the financial institution.

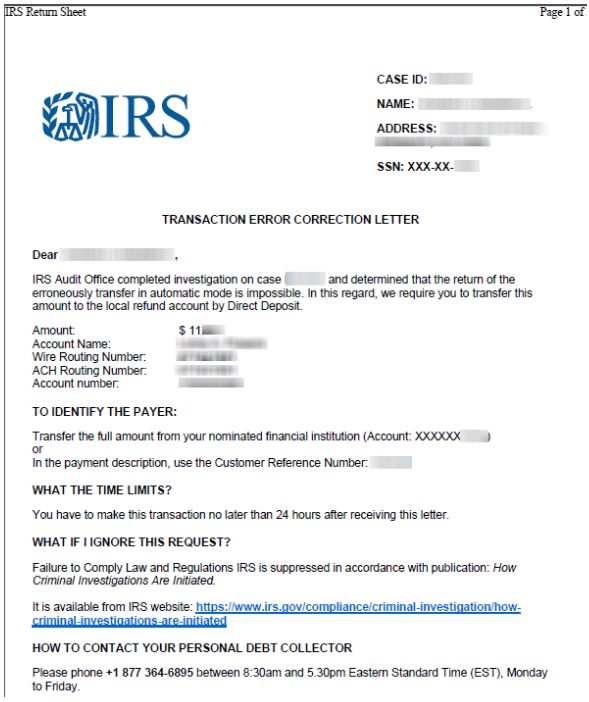

Problematic Adverts

Certain advertisements to own opposite mortgage loans believe that you earn “tax-100 % free money.” However, contrary financial continues aren’t taxed-an opposite mortgage are that loan, maybe not earnings. In addition to, the latest advertising constantly does not divulge the charge, standards, or threats associated with mortgage. Tend to, elderly people you should never grasp the newest terms of reverse mortgages, and you can deceptive messages only worsen this dilemma.

FHA manages new ads out of FHA-recognized finance and has now particular regulations having contrary mortgage loans. Not as much as FHA legislation, loan providers have to identify every requirements and features of your own HECM system during the clear, uniform words to help you users. Among other things, a lender needs to reveal every after the.

- FHA ensures fixed-rates and you can variable-rates contrary mortgage loans. Fixed-rates finance was marketed in one single lump sum no upcoming draws. Adjustable-price reverse mortgages render some other fee choice and enable for coming draws.

- The age of the newest youngest debtor determines extent you can score having a face-to-face home loan.

- The total amount you can buy during the first several-few days disbursement several months are at the mercy of an initial disbursement limitation.

Lower than FHA rules, loan providers can’t explore misleading otherwise misrepresentative advertising otherwise . Lenders will most likely not declare that some of items were supported by FHA otherwise HUD.

In addition to, a loan provider generally isn’t really allowed to use FHA or HUD company logos personal loans Arizona bad credit or seals or any other icon you to definitely imitates an official federal seal in its advertising.

County Laws Possibly Limits Reverse Mortgage Adverts

Certain claims, in addition to North carolina, Tennessee, Oregon, and Nyc, demand individuals criteria and you may constraints to your reverse home loan advertising. (Letter.C. Gen. Stat. 53-270, Tenn. Code. 47-30-115, Or. Rev. Stat. 86A.196, Ny SB 4407). These types of legislation fundamentally prohibit the lending company otherwise representative off misrepresenting situation activities or making not true pledges into the profit material getting contrary mortgages. Nevertheless they always want certain disclosures regarding situation regards to this loan.

Talk to a bona-fide house attorney or a foreclosures lawyer in order to understand if your state have one laws and regulations covering reverse mortgages.

Without precisely a fraud, people will be stay away from taking out an opposing financial to help you delay delivering Public Coverage masters.

Some reverse mortgage brokers and loan providers indicates older home owners to locate an other financial and also make in the gap during the money when you find yourself delaying Societal Protection positives up to these include earlier. Because the Societal Shelter professionals is delayed, the new citizen gets a permanent boost in this new monthly benefit whenever it start finding positives in the a mature age.

But, depending on the Consumer Economic Shelter Bureau (CFPB), the costs and dangers of getting an opposing home loan will most likely become more versus collective rise in Personal Security lifetime gurus you to definitely a resident carry out located by slowing down Social Safety. For more information towards dangers of getting an other financial to slow down collecting Social Coverage, understand the CFPB’s declaration.

Misrepresenting the possibility of Losing our home

Specific brokers incorrectly declare that you may never beat your residence or face foreclosure by taking aside a face-to-face financial. Due to the fact talked about over, that it claim is not genuine.

Access to Superstar Spokespeople

Reverse mortgage brokers commonly explore stars including Tom Selleck and you can Robert Wagner inside their advertising. While this isn’t necessarily a scam, the usage superstar spokespeople is actually computed.

This new lender’s mission is to make us feel pretty sure regarding tool. As you believe this new spokesperson, you might feel like you don’t need to find out the information regarding the mortgage. It is from the lender’s best interest on how to stay unaware. Knowing most of the standards and you may effects off a contrary mortgage, you think twice from the getting one.