On the wake of your Great Credit crunch out of 2009, area financial efficiency rebounded in conjunction the remainder of the brand new financial industry. By the 2015, community financial institutions had gone back to pre-drama profile with regards to noncurrent funds, internet costs-offs and you may portion of unprofitable establishments. But not, profitability has remained below pre-drama profile in recent times.

Core deposits turned into stagnant over an effective about three-season period getting community banking institutions having lower than $10 billion in property. You to definitely dormancy intended that these financial institutions’ freedom try considerably minimal, in addition to their lending ability is actually rather reduced.

According to a current statement away from , Nearly that-third regarding bankers rated possibly center deposit increases and/or prices off money because their finest complications. Subsequently a good amount of points features resulted in such concerns in the Financial Characteristics industry.

When you find yourself foot people to branch offices ended up being coming down in advance of this new pandemic, COVID-19 expidited the newest development. Branches will unquestionably continue to give really worth with the foreseeable future, however, real financial locations may has a diminishing impact on deposit gains. Revenue experts discover on growing when you look at the-people check outs to your branches here.

9 Financial ]

Additionally, of numerous people are giving an answer to new feeling you to inflation is wearing their monetary arrangements. Having rising will cost you, everyone is spending many depositing shorter. Its critical for financial selling advantages to save users informed on the competitive rates or other financial steps to help counter the latest loss of buying stamina during the inflationary minutes is crucial.

Regional banks and you will borrowing from the bank unions even more need execute active lender sales ways to arrive at and you may teach their address watchers to possess monetary properties.

Modern Financial Behavior

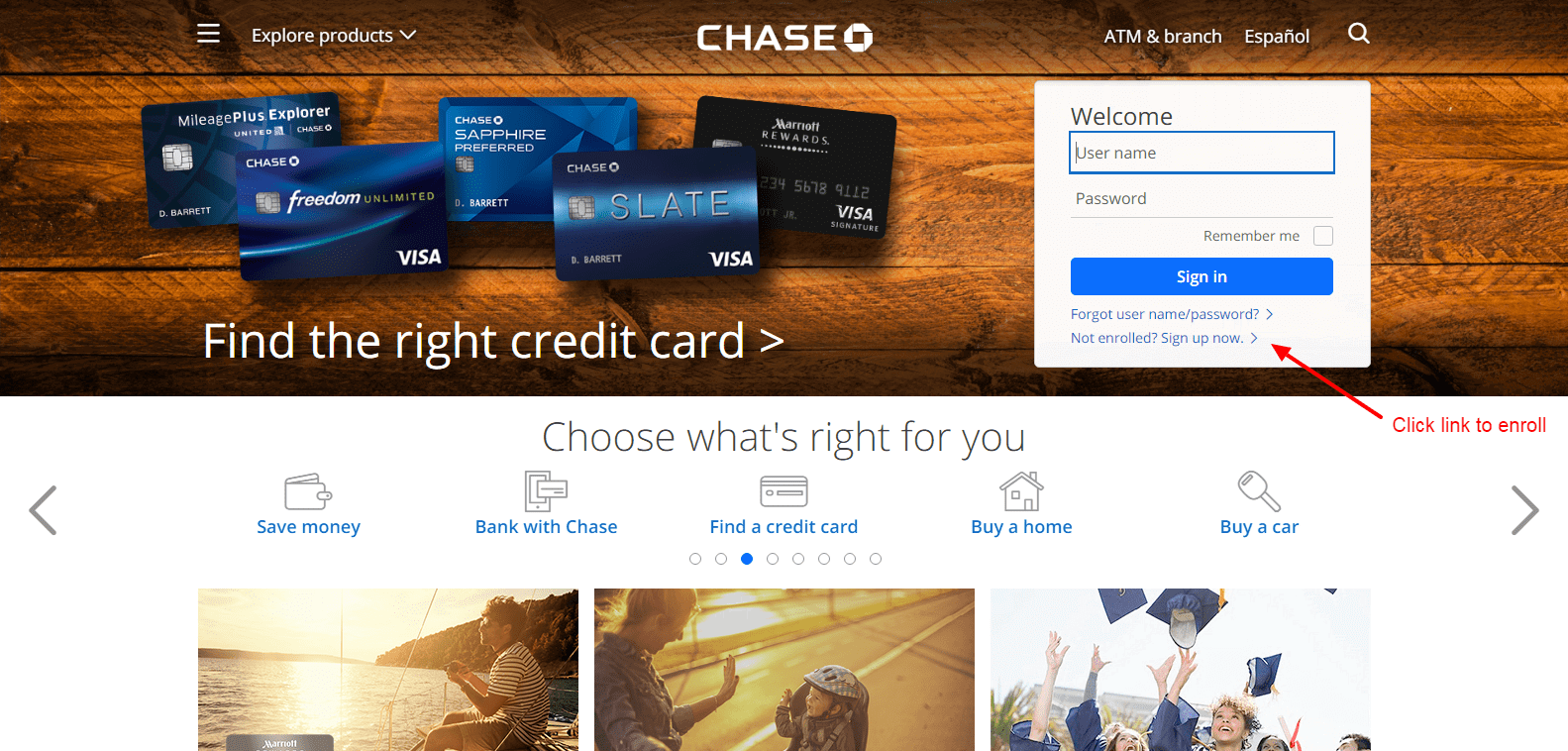

The average American’s financial conclusion is really other today than simply they was in 2009. 6% away from U.S. full banks signed adopting the overall economy, and is also estimated that 20% of all of the branches commonly close in the next few years. Shopping branch practices have traditionally already been a market advantage getting local financial institutions, however the need for local financial twigs to grow address segments could be dwindling. Instead, local financial institutions is to invest in electronic financial and you can cellular banking software. At the least to possess transactional banking purposes, of many users cannot remember the history time they walked toward an effective real financial. And even though national banking institutions appreciate extensive brand name sense as a result of immense marketing finances, awareness of neighborhood banking institutions and you may borrowing unions in their local industry is usually approximately half regarding megabanks. That it gift ideas a major difficulty to possess local FIs since the majority people interested in a checking account already have a brandname in mind, and you may mostly wind up opting for one brand (look for Oliver Wyman studies). To help you appeal and you will keep depositors, regional banks must adjust how they take part users and you will identify their brand name. For example allowing users choose tips lenderwhether or not meaning seeing a https://paydayloanalabama.com/nauvoo/ region branch otherwise experiencing the benefits out of digital banking and mobile financial software.

Because you plan a deposit development strategy for the people lender otherwise credit relationship, evaluate these important strategies for growing center dumps:

With respect to the California Web Be concerned Index, 88% from users will store online very first ahead of beginning a bank checking account. You may be brand new nearest financial institution, and you can get the best costs to suit your put profile, yet, if your opposition is actually controling the major normal positions during the Yahoo and you may Bing search efficiency, then you are lost new clients. Was your potential prospects also aware of your bank?

Local Seo (seo) is key so you can increasing your internet profile for each of the branches. Of a lot issues donate to performing a thorough local Seo means, but check out important strategies which you can use so you’re able to enter front of your potential customers:

- Regional Map Posts: Carry out and verify on line postings for every of the branches inside Bing, Bing, Fruit, or any other reliable company directories. This particular article generally looks significantly more than natural efficiency when a location look is done and offers a breakdown of one particular suggestions you to your clients you would like really: part target, times away from operation, contact number, a link to the site, and you may tips to lead all of them right to your door. Getting some 5-star product reviews for these posts increases your own credibility, giving potential prospects a greater sense of depend on that you’ll manage to enable them to.

- City-Specific Articles: Do pages in your webpages per of your bank’s branches. Flesh all of them aside with email address towards part, a leading-high quality picture of the building, and also the address. Do not forget to add few sentences regarding original unique content you to determine the support you provide, your staff, etc. Input a relationship to your own deposits page to aid push interested individuals into the convinced users. Such issue work together to assist for every part area page rank large regarding google search results. A lot more department location web page recommendations here.

- Business Feedback Websites: If you extra your organization or otherwise not, review sites such as for example Yelp and you will Yellow pages likely have factual statements about the places. Guarantee that each of your branch cities try detailed and appropriate throughout these internet. Consider each list in order that their target, contact number and circumstances of procedure are all right up-to-day. Once again, benefiting from 5-superstar product reviews on these web sites tend to reinforce the credibility.

- Content Income: Starting posts which is beneficial to your listeners is an efficient solution to arrive at the latest applicants when you are providing beneficial resources one to boost engagement which have current users. This is exactly a electronic online marketing strategy employed by financial institutions to bring almost any product or service. One strategy is to would posts you to definitely answers all the questions away from customers and prospects. Take dumps particularly analysis people apparently want to know concerning the differences between this new levels you render, if they should propose to continue some currency in their account, or if multiple offers membership will help remain its deals needs focused during attacks out of higher rising cost of living. Such topics is also inspire the newest bits of stuff that will instruct your audience and open a line of communications toward community financial.

Making use of these local Search engine optimization methods will even allow it to be likely to be getting potential prospects to find you compliment of Yahoo searches and you can business feedback internet sites. When your guest have got on your web site otherwise went along to that of your own twigs, the time has come presenting an attractive bring for good the new put membership.

Such methods are usually used in increasing your on the internet profile in order to a neighbor hood audience and can yield long-label overall performance. If you’re looking to target a certain audience, read on for more information.