cuatro. Waiting into Major Requests

/cash-app-logo-180e2a0d248a4357bd9642f328a643a3.png)

Speaking of playing cards: while you are getting ready to pick a house, now could be perhaps not enough time so you’re able to splurge on your credit cards.

Not merely does it damage your credit score and your DTI, it allows you to look reduced stable along with your profit.

In addition, it applies to the period of time involving the pre-approval and you may closing towards the a property. Their investment can also be slip thanks to any kind of time section ahead of closing time. Hold back until there is the tips available before buying furniture regarding new home.

5. Research your facts

When you’re looking to home financing pre-acceptance, the financial institution doesn’t only reach favor your. You are able to find the lenders, too.

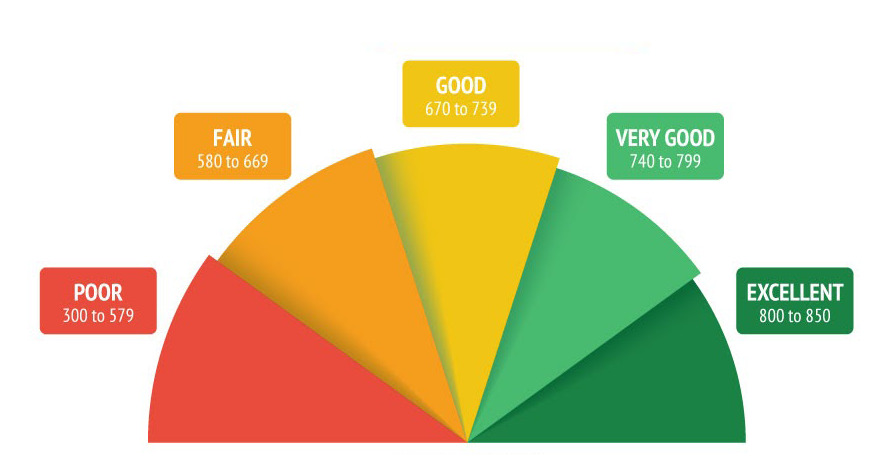

A factor to consider will be your credit history. Some lenders promote higher interest levels nevertheless they merely accept consumers with high credit scores. Others be a little more specialized in lending to the people with straight down borrowing score.

Be sure to think about your downpayment. Different kinds of mortgage loans has some other minimal down payment quantity. You won’t want to waste time making an application for an excellent pre-recognition with the a home loan that requires twice as much getting a good advance payment as you have spared.

Don’t let yourself be scared to ask concerns. Understand good lender’s minimums as well as the alternatives they supply ahead of your use. Read studies also to find out if its latest consumers are content along with their solution.

six. Keep money Stable

Your income is a vital section of their pre-acceptance as loan providers need to know you have new setting no credit check loans Greenwood Village CO to spend them right back. Your financial wants your income getting as stable and you will foreseeable that one can.

Due to this fact, if you’re preparing for a mortgage pre-acceptance, now isn’t the time to alter efforts. Acknowledging an advertising from your own newest company is ok, but don’t changes companies otherwise professions right now.

Just as in your debt, these suggestions offers compliment of if you don’t personal on the property. For people who changes work or stop your work just before closure, this may slow down the procedure otherwise their mortgage you can expect to slide using entirely.

seven. Prefer Your Time

Very bad facts will remain on your own credit history to possess eight many years. It may feel like ages since you fixed a series membership five years before, but it will come back once again to haunt your that have a home loan pre-recognition.

For those who have a bad mark-on your credit history one to is not away from the latest eight-season limit, it’s a good idea to wait until you’ve entered you to range. If you’re unable to, the fresh new extended it has been just like the you to definitely bad foundation searched, the better.

8. Cram Your Schedule

These are timing, are you aware it’s best to make an application for pre-approval off loan providers in the because the short of an amount of while the you’ll?

It is usually wise to incorporate that have multiple loan providers evaluate the fresh rates and you may financing quantity he could be happy to offer you. For those who get them contained in this a two-week period, they are going to apply at your credit rating as the an individual hard query.

A hard query are a software for brand new borrowing from the bank, eg credit cards app or application for the loan. When you have more than two tough questions in this a year, they actually starts to lower your credit history.

For folks who get pre-acceptance of three lenders within two weeks of each and every most other, your credit history notices one to difficult query. For those who hold off a month anywhere between for every application, the statement suggests around three difficult concerns.

nine. Learn The Real Down-payment

Closing costs, being always on the 3% of one’s home’s purchases speed, is actually aside-of-wallet. This means you need to have that money on your own deals membership ready to go.