A great USDA loan are a federal government-supported, no-money-down financial specifically designed to have buyers and you may land inside shorter-thick areas, also outlying and you will residential district section during the Fl.

If you’re considering to get property outside of towns, the fresh USDA’s home loan system could offer you many perks, as well as all the way down interest rates and you will payments than the most other bodies-recognized programs such FHA and Va.

In the Florida, the latest USDA means the usa Company of Farming, a company notable for the engagement inside agriculture, forestry, and restaurants-associated effort.

To decide when the a house is approved to possess a USDA mortgage, you could potentially make reference to new USDA Qualification Chart. Believe it or not, 91 per cent of your own Us, as well as some other part of Fl, drops in the USDA border.

This means that if you find yourself a first-go out family client thinking of buying a property beyond urban portion from inside the Fl, with the USDA’s mortgage program is a viable solution.

How come a beneficial USDA Financing Really works?

USDA finance inside the Florida try line of because they’re secured by the the fresh You.S. Agency regarding Agriculture, decreasing the exposure for mortgage lenders and permitting them to offer lower rates of interest. These funds do not have prepayment charges, enabling individuals to settle its funds early in the place of even more fees.

Because of the USDA verify, these types of money usually have rates of interest doing 0.50 commission affairs less than other low-down-payment choice instance HomeReady, HomePossible, and you may Old-fashioned 97, actually less than Va mortgage loans, delivering high savings for homebuyers.

How come The newest USDA Define Outlying?

The expression “rural” getting USDA funds in Florida comes from Section 520 off the new Homes Work from 1949.

Communities not conference such rural conditions are known as “urban.” It is vital to observe that no particular government definition can be acquired to possess suburbs otherwise exurbs. Hence, the All of us residential property are categorized as rural otherwise urban.

Within the 2020, the latest Census Bureau introduced extra requirements to recognize between outlying and you will urban areas within amount of census tracts. A rural census system is described as fulfilling the second requirements:

- That isn’t within this an one half-distance radius regarding an airport having an annual traveler number out of 2,five-hundred or Sumter savings and installment loan higher.

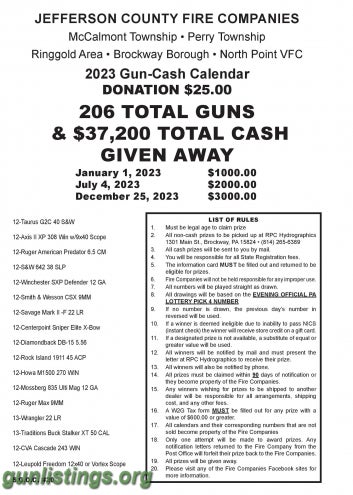

USDA Qualifications Map

![]()

You need to use this USDA qualification map to get a message to check out whether or not a house currently matches the USDA’s possessions qualifications criteria.

Utilising the USDA chart, you might quickly see whether property we want to purchase could well be entitled to the application. Areas entitled to services can alter yearly and so are determined by the populace density or any other factors.

A USDA-recognized financial instance MakeFloridaYourHome can be ensure the brand new eligibility of all the qualities you would like. To save lots of time on qualities that might not eligible, it is advisable to get in touch with good USDA-accepted bank to confirm the address having an excellent USDA mortgage.

How will you Qualify for a beneficial USDA Mortgage?

Potential home buyers must fulfill certain criteria of assets area and you will income so you’re able to qualify for a great USDA financing in the Florida. As well, they should meet almost every other important financial qualifications.

Assets Venue

The house purchased must be into the an outlying census tract defined because of the USDA. The property’s eligibility might be confirmed using the USDA web site otherwise consulting your lending company.

Income Eligibility

Homebuyers need to have a family money when you look at the USDA’s specified low to moderate earnings limits because of their area. Such restrictions are available towards the USDA website otherwise is acquired courtesy a dialogue with MakeFloridaYourHome.

Credit history

Candidates are needed to display a normal reputation for with the-go out bill costs, proving their capability to manage economic responsibilities effectively.