All told, you’re sinking $120,000 into your account, which is a lot of money. But if your investments during that time generate an average annual 8% return, which is below the stock market’s average, you’ll end up with about $275,000. To calculate how much your money can grow with compound interest, use the US Securities and Exchange Commission’s compound interest calculator. Enter in the amount of your initial investment, your monthly contribution (if any), the amount of time you plan to save, the interest rate and the compound frequency. That’s an extra $42 just for parking my savings in a higher-yield account. Keep in mind, however, that savings accounts earn a variable interest rate, meaning the APY can change anytime.

Why go with a high-yield savings account?

- In my case, I set up a recurring automatic transfer of $100 from my checking account into my Ally savings account every month, which breaks down to $25 a week.

- In our series of Money Box programmes on The Death of Retirement we talk a lot about the benefits of compound interest.

- The higher the balance in an account, the more you’ll earn in interest.

- APY is the best measure of how much you’ll earn from a savings account.

- You earn an average of 4% annually, compounded monthly across 40 years.

- Start by depositing $1,000 or a suitable amount in a high-yield savings account that earns 4% to 5% APY.

Compound interest earns you interest on interest already earned from savings or investments. For example, if you earn $1 in interest from a savings account, that $1 would be included in the calculation to determine the next month’s earnings. APY is the best measure of how much you’ll earn from a savings account. For investments, https://www.kelleysbookkeeping.com/financial-forecasting-vs-financial-modeling/ consider risk and expected return when deciding where to invest. In the investment markets, higher returns often come with more risk. Earnings will be minimal when you start with a low balance or earn a low interest rate, such as the 0.01% offered by many traditional banks, including this Chase Savings Account.

How do I open a compound interest account?

To calculate problems on compound interest, we need to be familiar of the term Simple interest. As it travels down the hill, the snowball continually picks up more snow. The so called “snowball effect” shows that small actions continued over the long term can have large impacts. This blog explains everyday economics, consumer topics and the Fed. It also spotlights the people and programs that make the St. Louis Fed central to America’s economy. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Compounding Period Frequency

This results in some very intimate moments between Oppenheimer and Einstein, in which the two discuss their differences in philosophies. Oppenheimer is genuinely depicted by Murphy to be a brash, even abrasive figure who generally avoids conforming to authority. Einstein is one of the few mentors whom he is willing to listen and show respect to. Oppenheimer recognizes that it was Einstein’s discoveries that laid the groundwork for his work on the atom bomb.

Approach Two: Fixed Formula

For example, there’s little benefit to earning 0.01% in compound interest on a $100 balance in a savings account. In 10 years, contributing $10 each month to the account, with interest compounding daily, you would only have earned 70 cents in interest. With the power of compounding, the interest you earn can grow exponentially over time, even if your interest rate doesn’t change. A famous quote attributed to Albert Einstein, though probably not actually said by him, states, “Compound interest is the most powerful force in the universe.

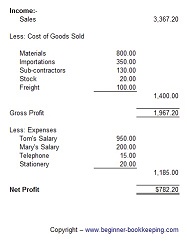

The more periods that you have for compounding, the larger its effect. You can’t get to the huge returns of the 30th year of compounding without building through the first 29 years of growth. The https://www.simple-accounting.org/ chart below illustrates the growth over a 30-year period for an account with simple 5% annual interest. The annual return grows from $5,000 in year one to nearly $20,000 by the final year.

If you are the someone “who earns it” from Einstein’s quote, then you are utilizing a powerful force to build assets. Generating income on interest that you’ve previously earned can totally transform a retirement plan for the better. Keep in mind that any interest you earn from a savings account is considered taxable income by the IRS. When tax season rolls around, you’ll have to include the interest you earned for the filing year on your federal tax return. When compound interest applies to your savings earnings, you’ll be able to get more value over time, though you’ll always have to factor in APY and the length of time you invest. If the APY on your account is far below 1%, compound interest will likely amount to a few extra pennies.

Every dollar that goes out the door as interest can’t be invested. If you pay compound interest, you have even fewer resources to benefit from compound interest. Stock prices tend to reflect the future cash flows that are expected to be produced by the underlying businesses. Equity valuations rise and fall in the short term thanks to supply and demand in capital markets, but long-term performance almost always reverts to cash flows eventually. At some point in a successful corporate lifetime, cash is distributed to shareholders, either as dividends or in a lump sum when the company is acquired by another. When push comes to shove, these events produce returns for shareholders, and a stock’s price generally can’t stray too far from those expected future returns over the long term.

That’s enough to buy a small island for the birthday celebration, or just about anything else she or her family could want. Sometimes a comment is attributed to a famous individual to increase the prestige and believability financing activities of the comment. Also, a quotation from a famous person is often considered more interesting and entertaining. The first way to calculate compound interest is to multiply each year’s new balance by the interest rate.

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.