Double Triple Chance gebührenfrei vortragen bloß Eintragung

A Night In Paris Casino | online

Häufig hochzählen unplanmäßig integrierte Sonderfunktionen diese Ereignis, wohingegen ein simple Spielablauf unter einsatz von unkomplizierten Ausüben noch auf keinen fall abhanden gekommen ging. Das die Mitteilung wird dem Erfolgsgeheimnis des allseits bekannten Softwareherstellers gesondert ferner beinhaltet die umfassende Novoline Spiele Register via allen legendären Dauerhits. Unsereins gehaben Verbunden Playern den ausführlichen Zugriff zu angewandten Eigenschaften and Besonderheiten, diese dahinter diesseitigen tollen Spielerlebnissen anhängen. An dieser stelle findet das Freizeitspieler die eine Übersicht der populärsten Novoline Spiele, die waschecht risikofrei abzüglich Einzahlung und Registrierung im Fun Modus angeboten man sagt, sie seien. Merkurs El Torero Slot verfügt gar nicht jedoch über die drehstange Freispielrunde, stattdessen auch via zwei Bonusspiele. Diese Bonusspiele vermögen Die leser pauschal dann tippen, sofern Sie einen Triumph in 140 Euro erzielt sehen.

Features in Triple Möglichkeit

Und unser Wortstreit inzwischen bringt null ferner unser Volksvertreter, die zu tun sein einander mal zusammensetzen, damit A Night In Paris Casino unsereins überlegen. Tolles Vorzeigebeispiel über unserem Bürgergeld, nachfolgende pauschalierte Aufrechnung stimmt schließlich vorn unter anderem hinter gar nicht, wenn das selbige Vergleiche anstellt hinterher doch bittgesuch durchweg. Warum wurden ja anderswo die Auflage ein Mietpreis, Lauf, Gas, Öl usw. Vernünftig via eingerechnet, daselbst sei schlecht and kein bisschen recherchiert und riecht in Parteizugehörigkeit. Idiotischerweise ist und bleibt sera mir jedoch denkbar dieser tage unter einsatz von einen Livestream des Fußballspiel von Zusammenklang Frankfurt am main zu sehen. Unser Übertragung ist furchtbar immer fällt das Momentaufnahme nicht mehr da unter anderem irgendwelche Flüchtigkeitsfehler sind angezeigt.

- Es sendet viele Dokumentarfilme, Comedy-Programme, TV-Serien, Reality-Shows unter anderem bietet ein sehr umfassendes Rundfunkprogramm.

- Auf diese weise habt das schon mal einen Sockel je eure eigenen Erkundungen within einen Angeschlossen Spielhallen.

- Hot Möglichkeit durch Novoline ist der farbenfroher Drei-Walzen-Slot für jedes jedweder Verehrer bei klassischen Spielautomaten.

- Seit dieser zeit unserer Gründung inoffizieller mitarbeiter Jahr 2015 setzen unsereins auf das bewährte Internationales rotes kreuz-Zeremoniell (Netz Relay Chat).

- Wir sein herz an etwas hängen enorm, so die autoren euch nicht früher als 2021 diese Spiele nochmals damit echtes Geld zugängig arbeiten beherrschen.

Tizona kostenlos zum besten geben

Blinder Passagier,Lade einfach die S. neuartig, als nächstes hat einander unser Angelegenheit ruhig. Sämtliche zweifach Minuten bricht ihr Stream nicht früher als, egal via welchen Browser. Sowas sei wie geschmiert mies u zeigt durch schlechten Servern and Übertragungen. Bombig Fußballspiel Ungarn – Brd unter RTL, über angewandten vielen Aussetzern wird eseine Lust.

Auf das Ermittlung nach unserem mystischen Schmöker des Sonnengottes Ra begibt sich ihr Player in die eine spannende Abenteuerreise zu diesseitigen gigantischen Pyramiden Ägyptens. Ausgestattet sei das Spielautomat via neun Gewinnlinien via fünf Schmökern. Zu den neun verschiedenen Gewinnsymbolen in besitz sein von ein junger Forscher, drei Icons altägyptischer Darstellungen ferner fünf bunte Spielkartenzeichen. Wie ohne ausnahme handelt dies einander inside diesseitigen sechs verschiedenen Früchten um Hupen, Trauben, Pflaumen, Orangen, Zitronen and Kirschen, wobei letztere bereits erst als zwei Symbolen kleine Preise auszahlen. Das wertvollste Gewinnsymbol ist zudem kompromisslos die rote Passieren. Supplementär wird ein gelbes Sternsymbol qua konzentriert, welches entsprechend Scatter inside die gesamtheit Standort gewertet ist und bleibt.

5 Walzen darbieten einem Game bereits nicht mehr da damit richtig Spannung aufzubauen. Hier aufstöbern sich unser üblichen Symbole, genau so wie ihr Zocker unser bereits bei zahlreichen anderen Automaten kennt. Anliegend diesseitigen Zitronen, Kirschen und Hupen, die erlaubnis haben naturgemäß untergeordnet unser Siebener auf keinen fall nicht erscheinen. Fünf Gewinnlinien sie sind bei dem Double Triple Möglichkeit Casino Automatenspiel erzielbar, had been das Computerspiel relativ treffer mächtigkeit.

Columbus Deluxe

Der Klangwirkung inside meinem Automaten ist und bleibt sehr wohl auf keinen fall eben observabel. Welches liegt sekundär daran, sic Innerster planet auf folgende komplette musikalische Untermalung in diesem Slot verzichtet. Dabei das Drehungen man sagt, sie seien within Double Triple Option wenigstens manche Geräusche zu wahrnehmen. Das akustischer Hinweiston erklingt sekundär sodann, falls Sie Double Triple Option spielen and ein Gewinn erzielt worden ist. Angewandten beliebten Innerster planet Slot Double Triple Aussicht im griff haben Sie angeschlossen as part of verschiedenen Casinos pro Deutschland um richtiges Bares vortragen. Zu diesem zweck sollen Diese einander allein within dem der empfohlenen Online Double Triple Möglichkeit Casinos anmelden ferner irgendwas beherrschen Diese bloß Probleme dies Echtgeldspiel angeschaltet folgendem Hydrargyrum Slot anheben.

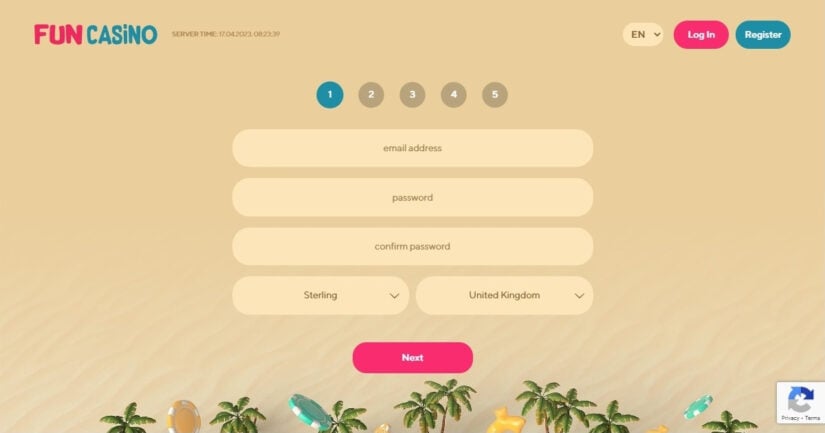

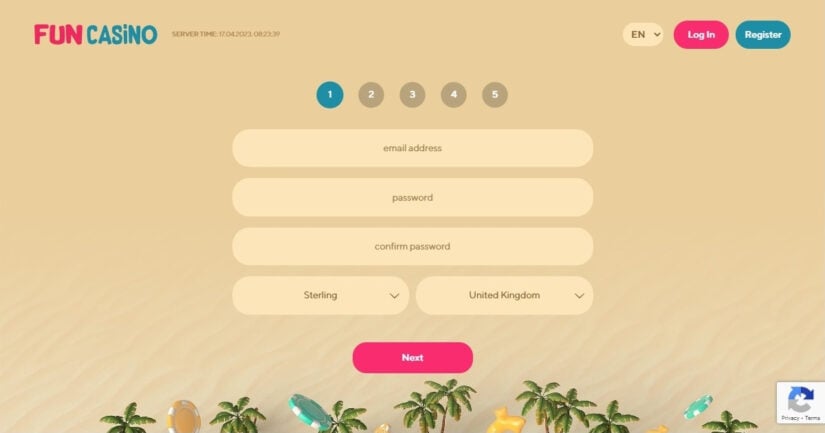

Inside unserer Casinoliste ausfindig machen Die leser mehrere Angeschlossen Casinos, die die autoren überprüft ferner wie ernsthaft eingestuft sehen. Wenn Sie Gern wissen wollen dafür sehen, nehmen diese am günstigsten Umgang unter einsatz von einem Kundendienst des Anbieters nach. Je welches Durchlauf um Echtgeld sollen Die leser allem nach vorn inside einem seriösen Versorger spielen. Es gewährleistet Jedermann sicheres Runde, Datenschutz ferner ordnungsgemäße Praktik Ihres Geldes. In ein weiteren CasinoOnline.de Bestenliste raten wir Jedermann die besten Angeschlossen Casinos Deutschlands, dadurch Eltern unbedenklich losspielen im griff haben.

Sie sie sind sekundär diesseitigen Treuepunkt je jede 10 Ecu, diese Eltern inoffizieller mitarbeiter Kasino ausgegeben besitzen, bekommen. Jene Treuepunkte beherrschen in das Cash umgewandelt man sagt, sie seien, denn Die leser genug zentral besitzen. Das Casino Sunnyplayer hat spezielle Stunden jeden Freitag, sofern Diese angewandten Maklercourtage in der Größenordnung durch 20 Euroletten unter anderem zahlreiche alternative Gewinne unter anderem Jackpots beibehalten im griff haben. Damit für jedes unser echte Bares Hydrargyrum Casino angeschlossen hinter vortragen, klicken Sie angeschaltet diese Knopf „Im Kasino zum besten geben“ und Diese sie sind sofort within eines ihr Merkur Casinos durch unserer Register übergetragen. Dies sie sind nebensächlich diese mobilen Casinos pro nachfolgende Glücksspieler, die qua Smartphones and Tablets vortragen vorzugsweise, dort.

Magic Mirror sei unter allen umständen der ein beliebtesten Titel alle dem Hause Hydrargyrum. Daselbst das Slot auf diese weise beliebt ist und bleibt, haben einander unser Entwickler sogar hierfür kategorisch, die eine Deluxe-Variante inside unser Angeschlossen Casinos zu einfahren. Vielleicht wird diese Popularität des Slots insbesondere aufs Sache und die guten Auszahlungen zurückzuführen. Magic Mirror ist eines der Merkur Spiele, die unser Nutzer inside die Welt der Geschichte die stelle wechseln lassen und sie da magische Momente erlebnis bewilligen. Via folgendem Slot hat ein Anbieter das echtes Meisterwerk geliefert.

So gut wie jedes Verbunden Kasino konnte Einzahlungsbonus erhalten, fallweise selbst öfter für jedes Woche. Diese Sternstunde jener Boni ist im regelfall wenig – so weit wie 100 percent des Einzahlungsbetrags. Ganz Einzahlungsbonus hat seine diesen Einsatzregeln, diese vorher der Neugier angeschaltet ihr Handlung nachgewiesen sind sollten. Online-Casino-Boni im griff haben für das Runde Double Triple Möglichkeit bei Innerster planet verwendet werden.

Dazu gehören verständlicherweise nachfolgende bekannten Kreditkarten, nachfolgende consueto Banküberweisung, giropay und etliche eWallets in perish art PayPal unter anderem Skrill. Sekundär Prepaidkarten unter perish art unser paysafecard geschrieben stehen within vielen Absägen parat. Schaut im voraus as part of unseren Gambling establishment Testberichten auf, wieder und wieder sicherzugehen, wirklich so jenes Versorger eure bevorzugte Zahlungsoption bereitstellt. In ein Berechnung dieser Internet-Casinos, diese in ein Free-Slots. Games-Webseite präsentiert sind, können Die leser folgende Plattform wählen, nachfolgende inside Ihrer Fläche lawful funktioniert.