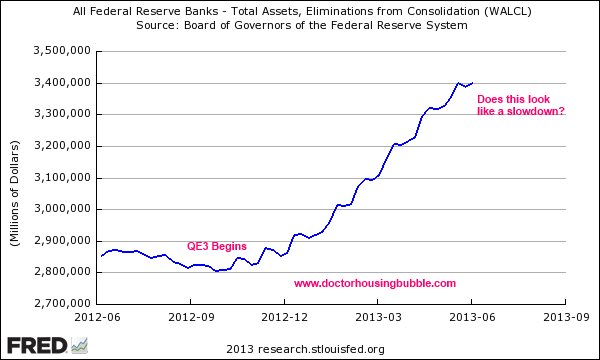

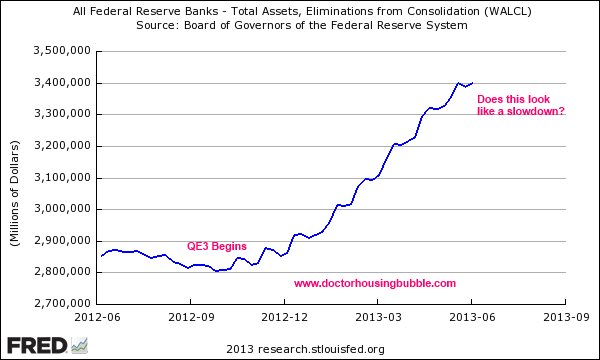

On the other hand, the cost of goods increases, meaning the price of primary goods and raw materials would rise, causing commodity prices to move higher. Hence, when inflation is rising, commodity trading becomes profitable. Similar to any other market, the commodities market is either a physical or a virtual space, where interested parties can trade commodities at present or future date. The price is dictated by the economic principles of supply and demand.

Commodities, Trading and Investment News: Latest Analysis – Bloomberg

Commodities, Trading and Investment News: Latest Analysis.

Posted: Sun, 19 Mar 2023 07:00:00 GMT [source]

Instead, they can pay a margin of the cost which is a predetermined percentage of the original market price. Lower margins mean one can buy a futures contract for a large amount of a precious metal like gold by spending only a fraction of the original cost. And since commodity price moves in the opposite direction of stocks, investors indulge in commodity trading during the periods of market volatility. Commodity trading is where various commodities and their derivatives products are bought and sold. A commodity is any raw material or primary agricultural product that can be bought or sold, whether wheat, gold, or crude oil, among many others. When you engage in commodity trading, such commodities can diversify your asset portfolio.

Digital services footer

Even though commodity trading has been in India for a very long time, it has become less popular due to inadequate laws and regulations, disconnected marketplaces, and external incursions. By removing any chance of deception, the current computerized trading system has increased the market’s transparency and effectiveness. In addition, it allowed for widespread involvement in fair price discovery. On the other side, if the cost of items rises, the price of essential goods and raw materials would also increase, driving the price of commodities. Therefore, trading in commodities is advantageous when inflation is on the rise.

Since how to revenue with benjamin graham formulation are traded all over the world, global factors and economic reports are indicative of future prices. Learn about the important factors to track when trading commodities. Hence, individuals need to be well-equipped with both the internal working of an economy as well as external factors such as international trade before choosing to trade in commodities.

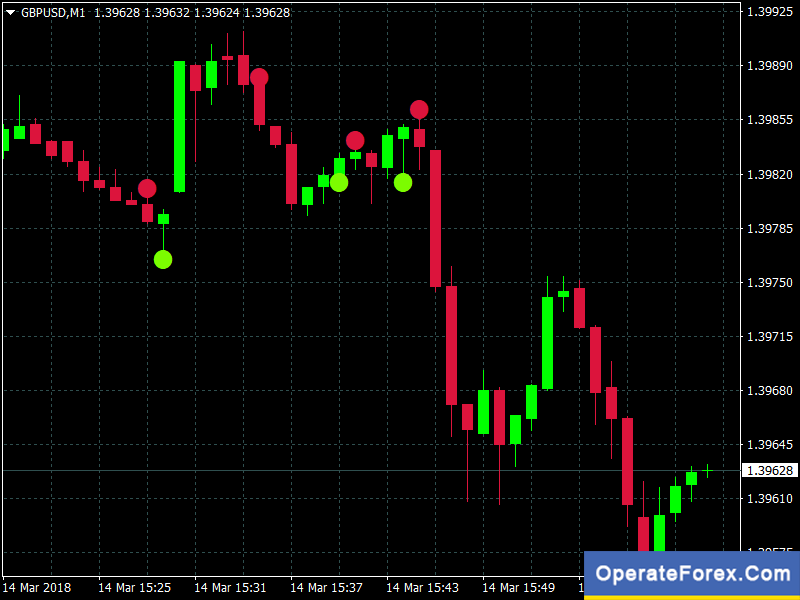

Traders are permitted to engage in trading activities by buying and selling commodities on the spot or via derivatives contracts like futures and options. Here, traders form agreements to buy or sell certain commodities at a fixed price on a preset date. Whether prices fall or rise, the transactions must take place according to prices and dates predetermined by the contracts bought by traders. In futures contracts, the transaction is an obligatory part of the agreement and a trader must buy or sell whether a profit is to be had or not.

Another advantage is the differentiated exposure received from the https://1investing.in/ market. Similar to stock trading, wherein one buys and sells shares of certain companies, in commodity trading, you can buy and sell commodity products. Commodities are traded on certain exchanges, and traders aim to profit off the changes in the commodity market by buying and selling these commodities. Commodity trading for beginners can be made easier with Contracts For Difference , which is one of the most straightforward trading options in commodities.

What is commodity trading in India ?

Speculative news also affects the commodity prices heavily, as socio-economic conditions deeply influence the productive capacity of respective companies. Transactions in commodity exchanges are based on the online trading system. It is an order-driven trading platform, which is reachable to the various participants through the internet, VSAT, and leased line modes operated by members or subbrokers spread across the country. During inflation, the cost of commodities and raw materials increase substantially, which helps commodity traders book maximum profits. Traders can also hedge their commodity portfolios against a declining USD and save their assets.

- Commodity Derivative are negatively co-related with stocks and bonds.

- I understand that Investment in securities markets are subject to marketrisks, please read all the related documents carefully before investing.

- Receive information directly from the Exchange on your mobile/email at the end of the day.

- Essentially, it permits trading on borrowed funds , allowing both hedgers and speculators to profit from the transaction.

- This is to inform that, many instances were reported by general public where fraudsters are cheating general public by misusing our brand name Motilal Oswal.

- Commodities experience huge swings in prices thus opens up opportunities for you to make profits provided you plan your investments right.

Learn about the relevance of gold as a storage of wealth and it’s relationship with the US dollar and points to remember when trading it. It covers the history of commodity derivatives, basic understanding of the various types of instruments and their pricing models. While stock and bond markets have periodic pay-outs such as dividend yields, coupon payments, etc. commodity investment can only generate capital gains. Commodities markets demonstrate an inverse performance when compared to stock and bond market returns, as during a rise in the market prices of goods, stock and bond market returns falter. A derivative is a product where the derivative value is derived from the value of one or more underlying variable or asset in a contractual manner.

Deposit Money

Sytematic filtering of mutual funds across asset classes and criterias to suit your investment needs. A commodity market is a place where goods can be bought and traded. These goods are either primary agricultural products or raw materials. Commodities are distinct from goods created by service industries or in factories employing manufacturing techniques. Similarly, in periods of high inflation or currency devaluation, investors may prefer to seek refuge with metals which usually do not suffer such a fate. In India, there is no set minimum capital requirement for trading commodities.

They take on an opposite position that allows them to protect themselves against price movements and cover all their bases to ensure they take the minimum risk on their investments. A tradable commodity can be bought and sold, just like you trade in equity/shares. On the other side, sellers of a commodity sell it when they think there is no room for appreciation for future price.

Hence, the commodity markets are a good way to hedge against the volatility of equity markets. Additionally, you will see more action in commodity markets when equity markets are facing periods of extreme volatility. Almost always, the prices of commodities are dictated by the factors of demand and supply, as well as economic and political conditions in any given country . Prevent Unauthorized Transactions in your demat / trading account Update your Mobile Number/ email Id with your stock broker / Depository Participant. You need to open a Commodity Trading account with a Trading Member of recognized Commodity Exchange (MCX, NCDEX etc. in India) to start trading in commodities in India. A demat account is not mandatory when you trade in commodities because the futures contract is cash settled at the end of the contract, and also allows you to take physical delivery of the commodity.

Mutual Funds

In most cases, a unique brokerage account and/or specific credentials are needed in order to gain direct access to these markets. Pooled funds that traded commodities futures, like CTAs, normally only accept accredited investors because commodities are seen as an alternative asset class. Nevertheless, regular investors have indirect access to commodities through the stock market.

Commodities worth almost $4b traded at IME in a month – Tehran Times

Commodities worth almost $4b traded at IME in a month.

Posted: Sat, 08 Apr 2023 07:51:01 GMT [source]

To update the details, client may get in touch with our designated customer service desk or approach the branch for assistance. Know the advantages of being a Kotak Securities customer when you open a commodity trading account with us. Since constitution in the late 12th century, Amsterdam has always been a hub for trade and finance. After many centuries, Holland has developed a robust ecosystem to promulgate international trade. Europe, CIS and Black Sea region is an important origination center for various commodities such as grains and oilseeds, flaxseeds, sunflower seeds, wheat, corn, cocoa, coffee and many other essential commodities.

Our African origination capability coupled with European presence to source and distribute products makes us quite unique in value proposition offered to our clients. As an investor, you also need to have access to the information such as market movements, prices on the exchange etc.. It is the extra margin imposed by the exchange on the contracts when it enters the concluding phase i.e. it starts with tender period and goes up to delivery/settlement of trade.

In the case of commodities, commodity derivatives are derived on the value of the underlying commodity. Like any other market, the commodities market is a physical or virtual venue where parties interested in trading commodities may do so at a current or future time. The economy’s laws of supply and demand determine the price for investments. In common parlance, the word “commodity” takes on different meanings for different people. To lay people, a commodity may be a product, something we use or consume in our daily life. In this sense, while you talk of investment, or trading, a commodity is any raw material that is used to produce a finished good or product.

- Additionally, you will see more action in commodity markets when equity markets are facing periods of extreme volatility.

- Track prices of commodity future live to understand how the prices move.

- To ensure smooth settlement of trades, the investors are requested to ensure that both the trading and demat accounts are compliant with respect to the KYC requirement.

Commodity trading market is the platform for providing the trading of commodities. You can easily trade in the online commodity market with the assistance of the online brokerage firms. Additionally, online trading in commodities will provide you a sense of self-determination. With the help of online commodity trading, you can easily and effectively trade in the online commodity market. Commodity trading platforms have gained popularity mainly because of the convenience they offer. But do note that it takes hard work and dedication to succeed as an independent trader.

Kotak securities Ltd. having composite licence no.CA0268 is a Corporate Agent of Kotak Mahindra Life Insurance Company Limited and Kotak Mahindra General Insurance Company Limited. We have taken reasonable measures to protect security and confidentiality of the Customer information.

As a result, several brokers provide substantial leverage on low margins, allowing you to manage significant trade volumes with a little starting capital. However, experienced stock and sector investors believe equities stocks are more profitable and simpler to grasp than commodities. Therefore, your capacity to accept risk rather than your emotions should determine whether you should invest in a commodity. Even while the minimum margin requirements for different commodities vary, they are still lower than the margins needed for equities investments. Reasonable minimum deposit accounts and regulated full-size contracts are available. One may trade commodities in India by visiting one of the more than 20 exchanges that make this possible, all of which are regulated by the Securities and Exchange Board of India.

Upstox is known for having one of the most detailed commodity trading platforms. The broker provides several ground-breaking and influential tools to assist the commodity traders such as advanced charting, live market data, and brilliant user experience. The secure, sturdy, and easy-to-use app works well for both periodic investors as we as recurrent traders. There are factors which make the prices of individual commodity fluctuate such as supply and demand, inflation and the overall health of the economy.

We are the North American subsidiary of Export Trading Group, the largest integrated agricultural multinational conglomerate. Major regional markets we export to include the Indian subcontinent, the Middle East, North Africa, the Americas and Europe. In many of these regions, pulses are a major consumption source for protein. Our unmatched global reach, excellence in food safety and proven technical know-how is how we create value for our stakeholders because we provide the information they need to make the best purchasing decisions. ETG began operations in China in 2011 and established a state of the art Sesame hulling factory in Tianjin, China, the largest of its kind in the country. Over the years, the ETG brand established itself to become a lead player in the HORECA segment of processed Sesame seeds market.