Borrowing from the bank or Credit ratings range from 3 hundred to help you 850. A high amount indicates all the way down risk. When trying to get home financing, any get more than 740 will be entitled to the lowest you can easily rate for the a particular loan. Another dos problems have fun with 670 towards the lowest FICO rating and you can 740 towards the highest get.

The newest Amounts

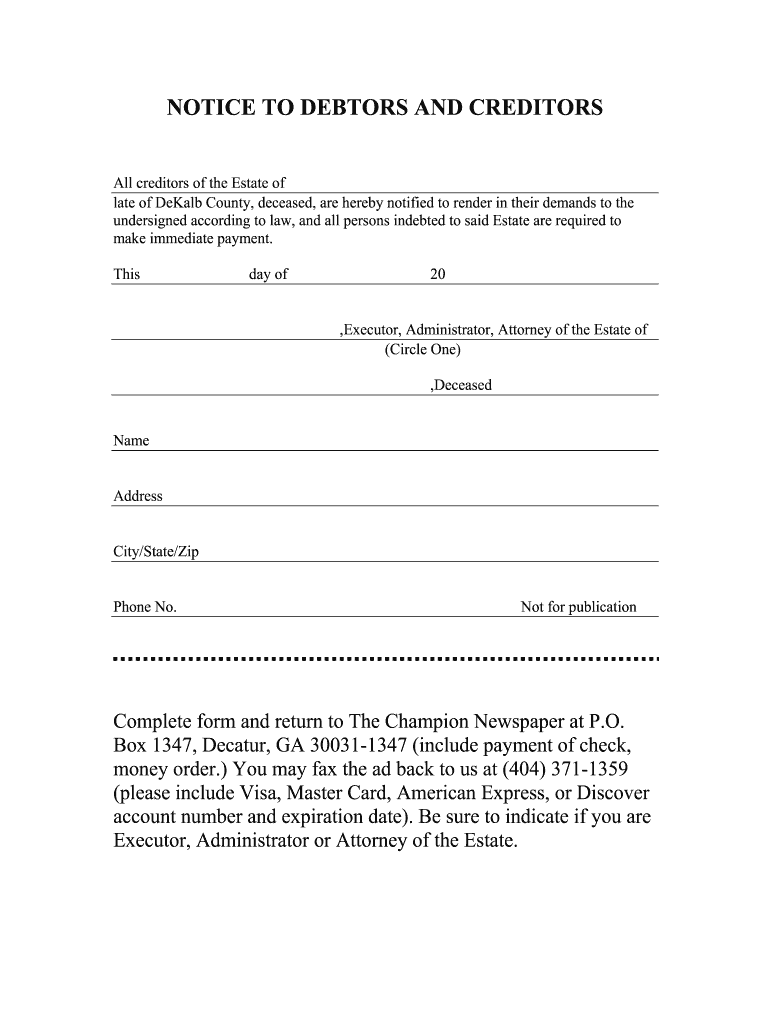

In https://paydayloanalabama.com/satsuma/ this circumstances, the rate towards the a 30-season repaired rates home loan to your sophisticated client (740+ FICO get) is 5.000% (5.173% APR) having a monthly payment regarding $2,494 (excluding taxation & insurance). The buyer that have fair/good credit (670 FICO rating) on a single variety of home loan is eligible to own a speed regarding six.500% (eight.016% APR) that have a payment per month from $3,103. One fee is actually $609 so much more per month, totaling $seven,308 per year the buyer is within that loan. Not only ‘s the lower FICO rating using alot more into the focus (six.5% compared to 5.0%), they are also investing alot more in private Financial Insurance coverage ($259/mo compared to $79/mo). Private Mortgage Insurance rates (PMI) needs by very loan providers whenever placing below 20% down payment. Understand the chart less than to possess a summary of brand new payment variations.

Your skill

It’s easy to find out how far improving your credit can save when buying a house. It will also save with the most other personal lines of credit and playing cards and automobile financing. It can even impression your house and auto insurance pricing. Exactly what can you do in order to alter your credit score for today.

Listed here are 5 ideas to assist enhance your credit score:

- Make your repayments promptly. This is actually the foremost question. They makes up thirty five% of your rating. 続きを読む