The higher the ratio, the more efficient you are at collecting receivables. And while how to get paid when you blog internationally not a traditional metric, customer satisfaction is important in assessing the effectiveness of AR management. Implementing automation software or tools allows you to automate repetitive tasks and free up valuable time to focus on more strategic activities. Note that regular reconciliation of payments with outstanding invoices can help identify any discrepancies or overdue accounts. It’s also important to note that any receivable management service you work with will need to adhere to industry compliance standards, such as ISO 9001 for quality management. We’re going to show you how to improve cash flow in small businesses here in this guide so you can stay ahead of issues and build up a safety net or invest in future opportunities.

Due Diligence: Inquiring About Data Protection and Security Measures

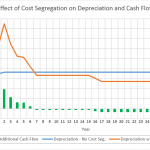

Experience the InvoiceSherpa difference firsthand and discover a smarter, more efficient approach to AR management. Try InvoiceSherpa free for 14 days and embark on a journey towards optimized cash flow and business growth. That’s why more and more small and mid-sized businesses are working smarter with the help of AR automation software, like InvoiceSherpa. By leveraging your technology you’re equipped with an advanced tool designed to transform the way you manage receivables. Your best bet to find out what it’s like working with a service provider is to get in touch with existing clients. This will give you a clearer picture of the provider’s effectiveness, professionalism, assets not subject to depreciation and customer service quality.

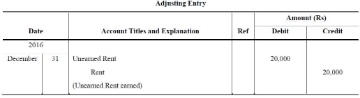

Its strength lies in providing a cohesive approach to financial management for large enterprises. Accounts receivable management commonly faces challenges such as high DSO, misalignment between sales and AR teams, manual processes, data fragmentation, workflow disruptions, and a lack of empirical data. To address these issues, businesses need to implement a structured and agile AR management system. Many collection issues stem from customer dissatisfaction with post-sales support. As a member of the finance team, you should ensure that all sales-related documentation reaches the customers timely. Additionally, you can streamline the invoicing process with meticulous attention to detail.

- Businesses can minimize payment delays with a checklist of billing processes.

- You can make things easy by providing multiple payment options, such as credit cards and ACH payments.

- By offering a range of payment options, you enhance convenience for your customers, eliminating the need for them to disrupt their daily routines to fulfill payment obligations.

- That’s where accounts receivable management services come into the picture.

What our clients and their customers say:

It’s important to tailor credit policies to your cash flow and business. Larger companies may have more flexibility and can offer longer payment terms to their clients, whereas smaller businesses may need to have shorter payment periods. Remember that the evolving business landscape offers even more innovative solutions, like technology-driven automation, which we’ll explore in just a moment.

Receivables management services: Should you outsource your AR?

But as we draw this conversation on accounts receivable management services to a close, it’s time to optimize your company’s financial management with InvoiceSherpa. When outsourcing receivables management, companies lose direct control over the collections process and communication with customers around invoices and payments. This can make it difficult to maintain a consistent customer experience and ensure that collections are handled in a professional and ethical manner. So when selecting a provider, ensure you opt for one that will act as an extension to your existing finance team, and will help you ensure a seamless, positive customer experience for your debtors. Effectively managing both accounts payable and accounts receivable is the key to your business’s fiscal well-being. This involves implementing transparent invoicing procedures, streamlined payment tracking, timely collections, regular reconciliations, stringent credit evaluations, and efficient payment processes.

Diversify Payment Options

Extend the reach and effectiveness of your collection team with a custom solution to meet your unique needs. Accept and manage credit, debit and ACH payments, and convert paper to electronic payments. Add a Pay Now button to your invoices and let customers pay online 4x faster than with paper invoices. We promised at the start of this conversation today that we’d introduce you to a better way to optimize your financial management. The fact of the matter is that small businesses (and even mid-sized companies) don’t have the time or expertise to manage AR.

It will help you manage global nuances, get accurate insights into customer behavior, and benefit from differentiated functionalities for timely and speedy collections. However, the benefits go beyond materializing sales and improving cash a beginner’s tutorial to bookkeeping flows. Outsourcing accounts receivable management allows you to focus on other aspects of your business. Outsourcing can also bring in expertise that leads to a more efficient process and improved performance. Ultimately, the decision comes down to each business’s specific needs and circumstances.

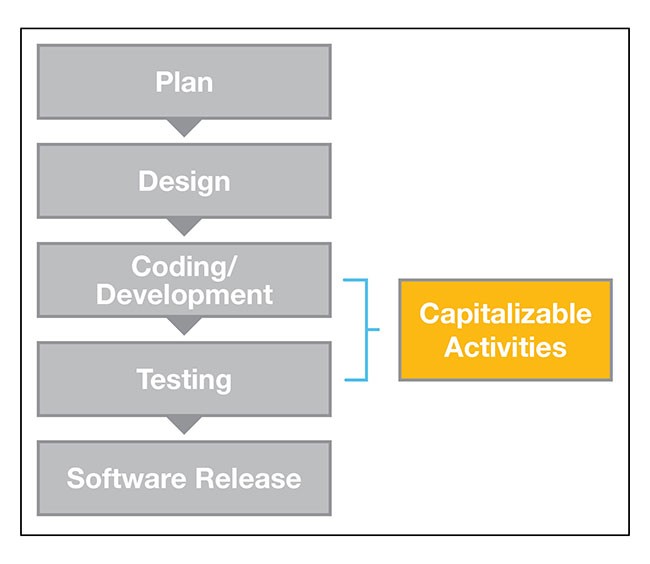

To automate and streamline invoicing and accounts receivable (AR) processes, implement invoicing and AR software. This software should integrate with your accounting system and other business applications to eliminate manual data entry and reduce errors. Automate invoice creation, sending, tracking, AR follow-ups, and collections.