Property is one of rewarding resource really customers individual long identity. Rather than other stuff you buy that eliminate value over a period of your time, a property worth expands from the time off get. Which improved value is known as equity.

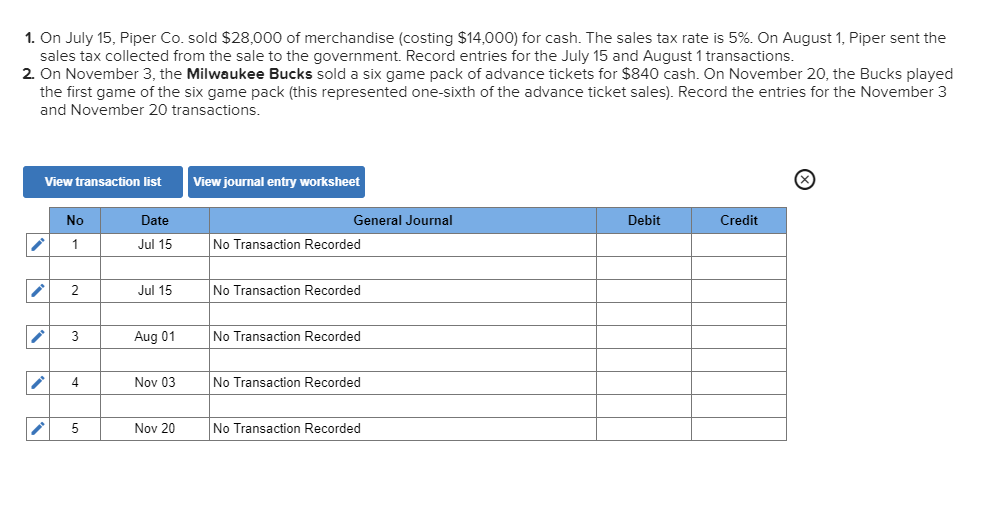

It’s the difference between the reasonable business property value additionally the leftover equilibrium on your mortgage. This means as you reduce the borrowed funds, you gain security. Finance eg family security money and you may reverse mortgage loans allows you to availability it guarantee to alter your financial mentality.

Taking out an equity loan of any sort is actually a life threatening financial decision. If you are considering property guarantee financing otherwise a contrary mortgage, communicate with a counsellor before you apply. Phone call Consolidated Borrowing from the bank now from the (844)-402-3073 to speak with a counselor free of charge. You can purchase expert advice about how precisely new money have a tendency to apply to your residence, mortgage and you can full financial outlook.

Just how do Home Collateral Personal lines of credit Really works?

A house equity line of credit enables you to supply this new equity you’ve accumulated in your home. Inside a routine housing marketplace, the value of a property increase much slower over time. Even although you dont live in an up-and-future industry, typical rising prices translates to property will probably be worth significantly more with every passing season.

It is essential to note, this will be simply genuine inside a consistent sector. Within the a weak business home values is also fall off. For those who have an effective , possessions opinions normally miss somewhat.

Of course you reside really worth way more today than simply after you ordered they, there is certainly obtainable guarantee of your house. 続きを読む

/StatementTransactions-56a1de4a5f9b58b7d0c3fa7e.jpg)

/macys-card-86a44e8242004b4d83fcf96a9eea817c.jpg)